Crypto as collateral. Trade the global financial markets using Bitcoin or Ethereum.

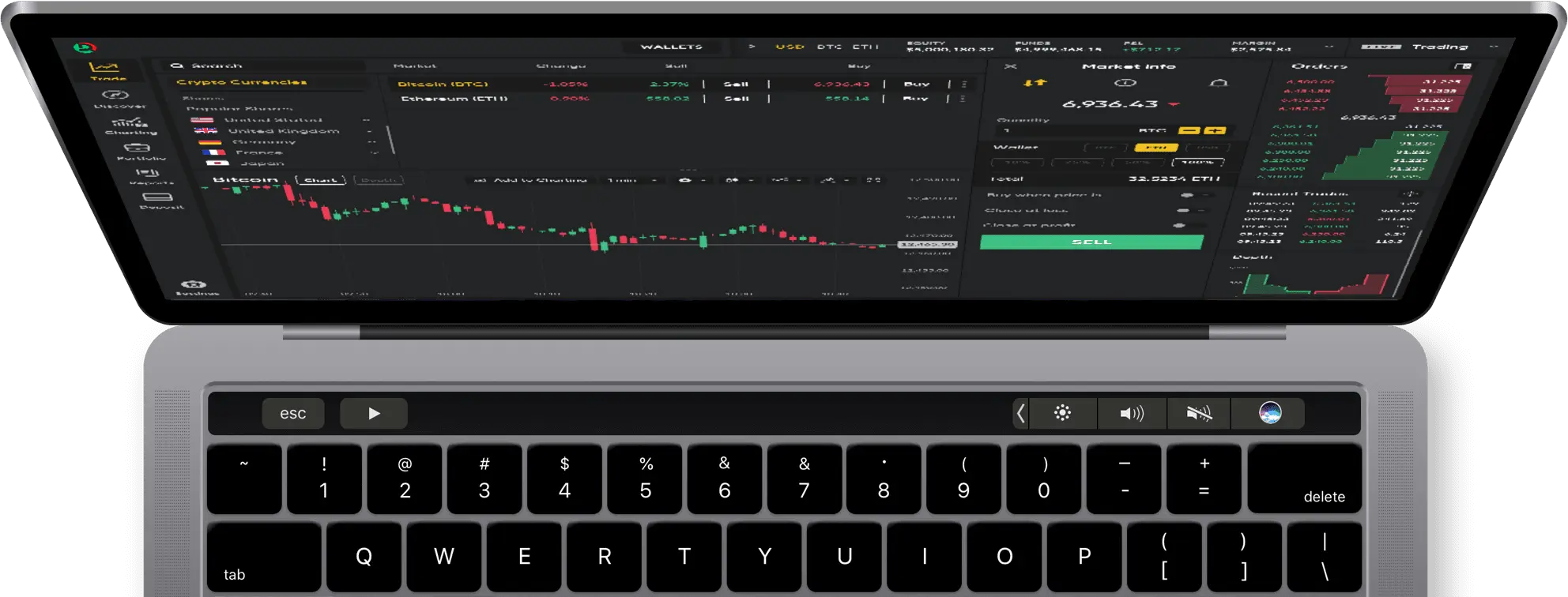

Our advanced web platform is the first regulated tokenised assets exchange in Belarus.

Trade over 150 tokens and expand your Bitcoin and Ethereum holdings.

Our advanced web platform is the first regulated tokenised assets exchange in Belarus.

Crypto as collateral. Trade the global financial markets using Bitcoin or Ethereum.

Security as priority. The safety of your holdings is guaranteed in accordance with the legislation of the Republic of Belarus.

Technical indicators. Keep an eye on your positions with over 75 advanced charts, price analysis and price alerts.

Control your capital. Use stop-loss and take-profit orders to keep what you earn.

Use the world’s first regulated tokenised assets exchange to build a diverse investment portfolio with your crypto holdings. Make your deposits in Bitcoin or Ethereum to trade global financial instruments with competitive leverage and tight spreads. Dzengi.com keeps your holdings secure and accessible at a glance.