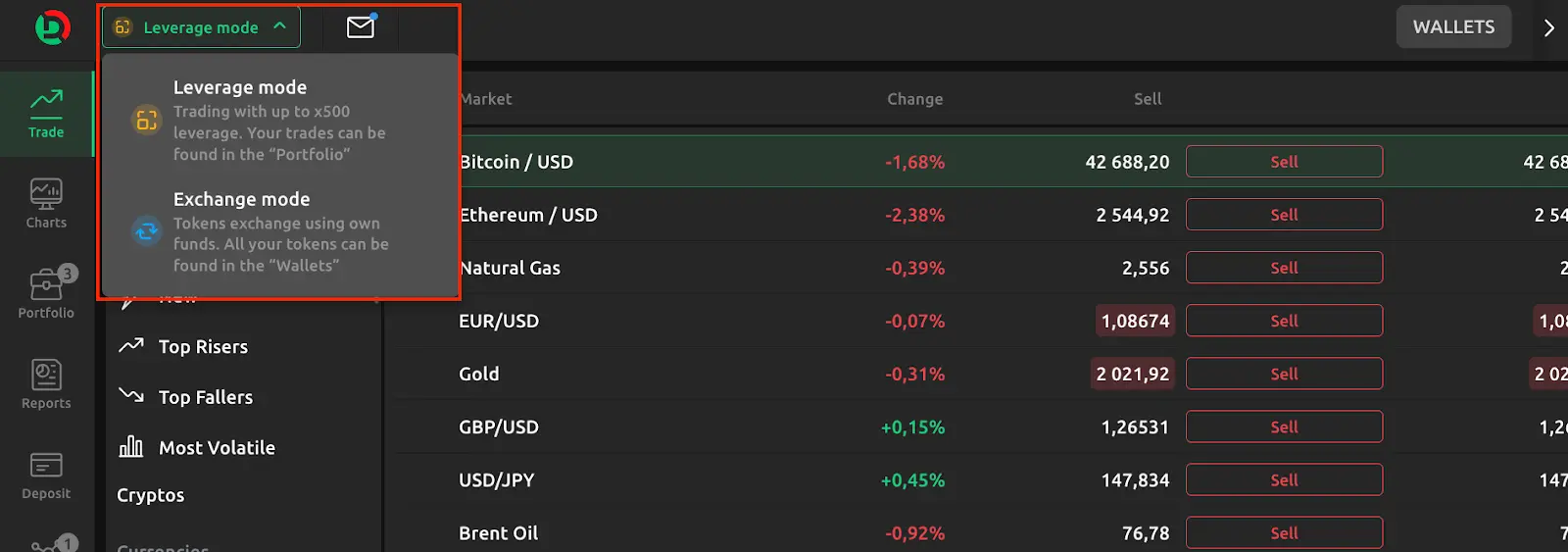

Existing trading modes and differences between them

In our Dzengi.com platform you as a client can choose between exchange and leverage trading modes the switcher between which you can find in the platform header.

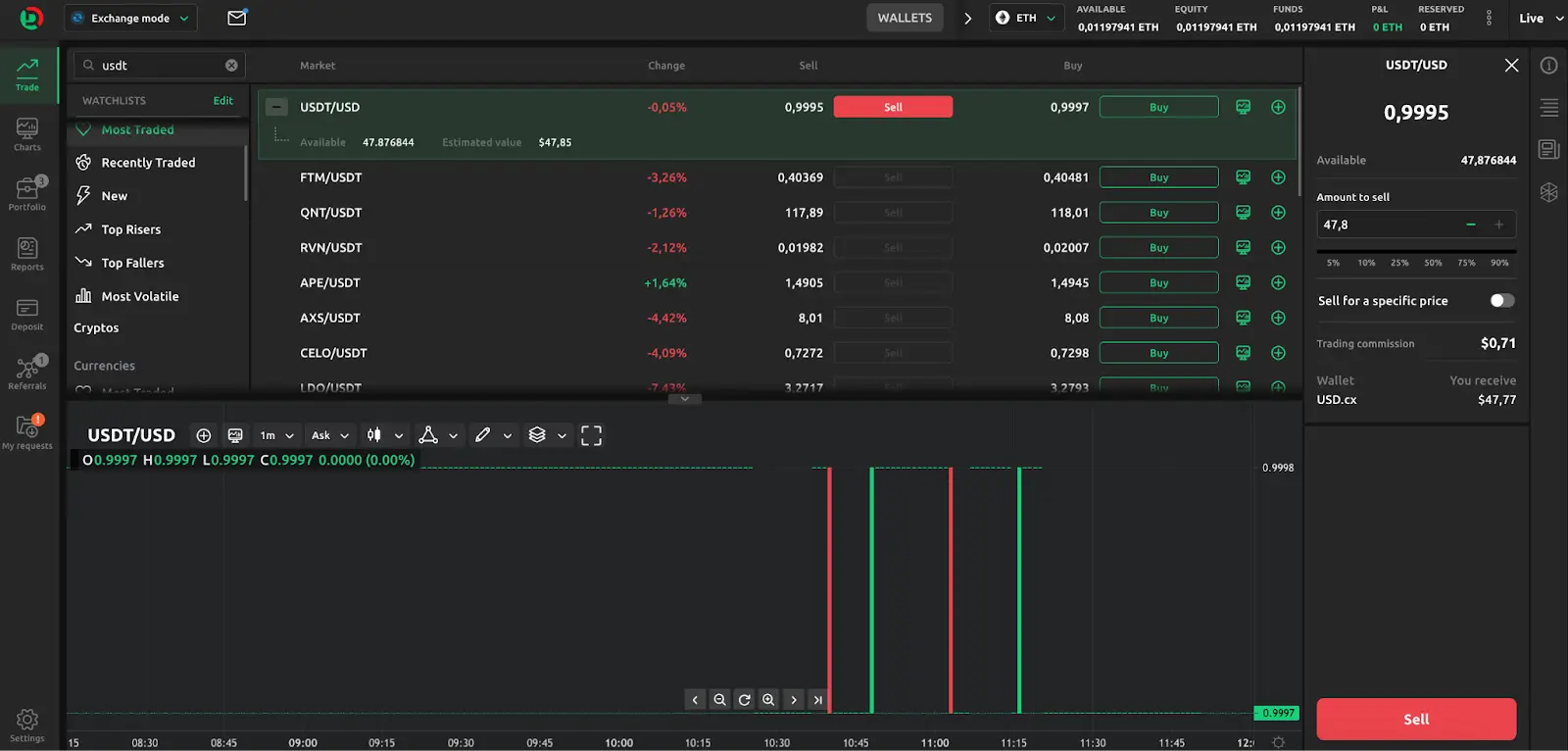

In the exchange trading mode you can conduct simple buy and sell market orders as well as set limit orders. Please note that sell market orders are possible only in case you already have a corresponding tokenised asset within your ‘wallets’ section.

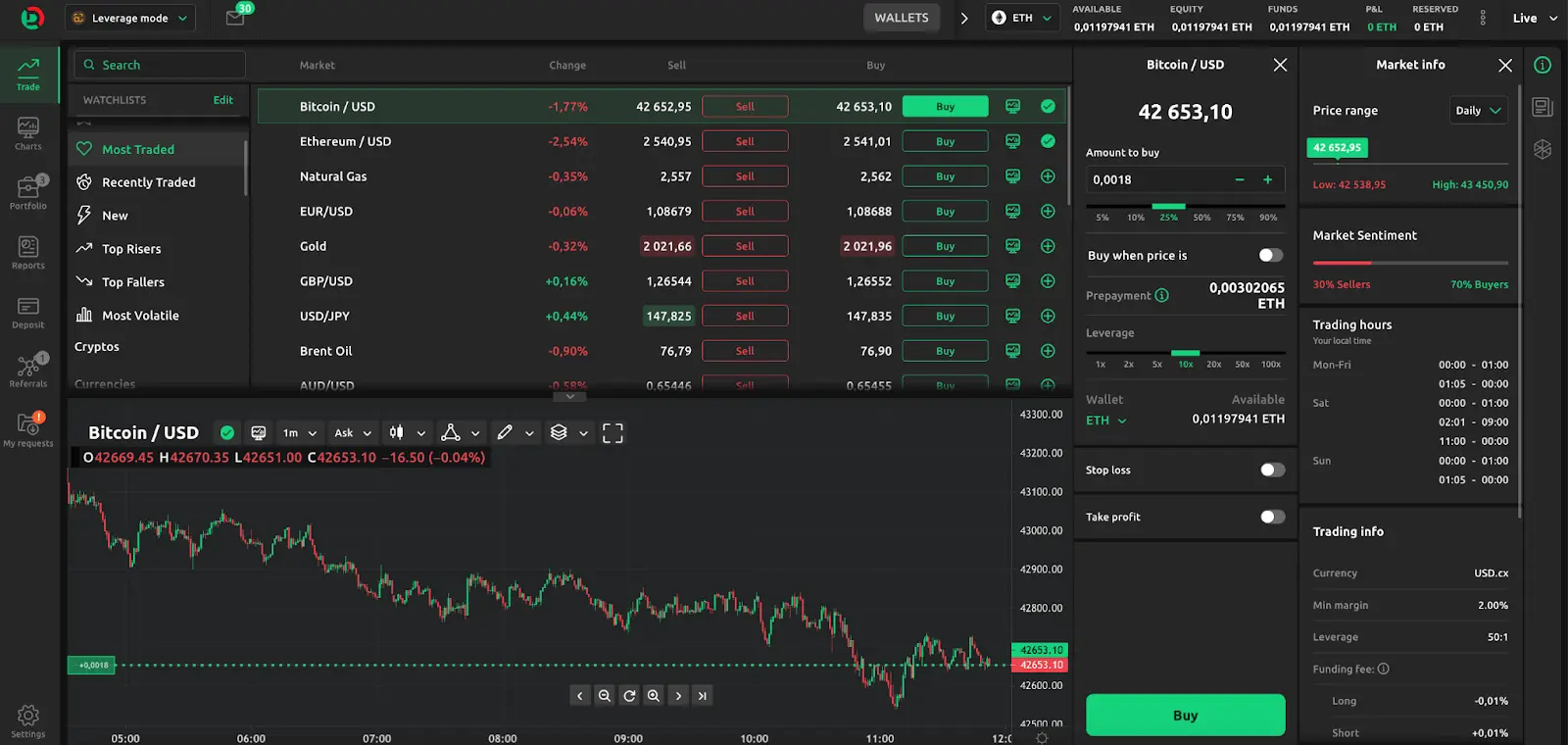

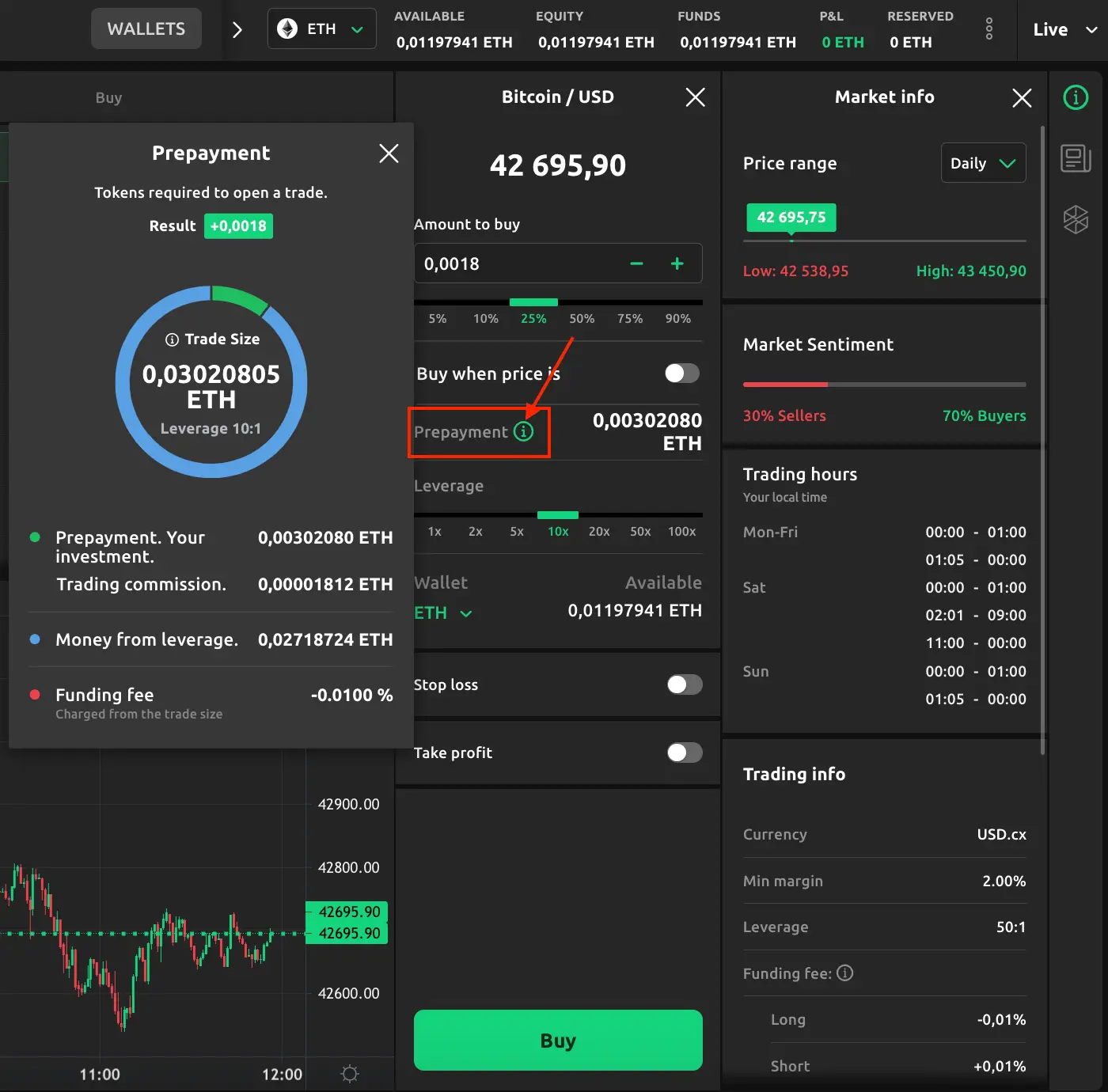

On the other hand, leverage trading increases your purchasing power. For example, with leverage of 1:10, it means that for a 1,000 USD.cx deposit, you can open trades worth a maximum of 10,000 USD.cx. In the leverage trading mode you can set market, limit and stop orders as well as specifying stop loss and take profit levels in each case. It is also important to notice that in this trading mode you can have profit by using short-operations.

Funding fees apply to leverage orders carried overnight at market rates. These fees are always transparently shown to the client. Please note that those fees are also charged for the days when markets are closed.

In terms of platform peculiarities the following differences can be mentioned:

| Feature | Exchange trading mode | Leverage trading mode |

|---|---|---|

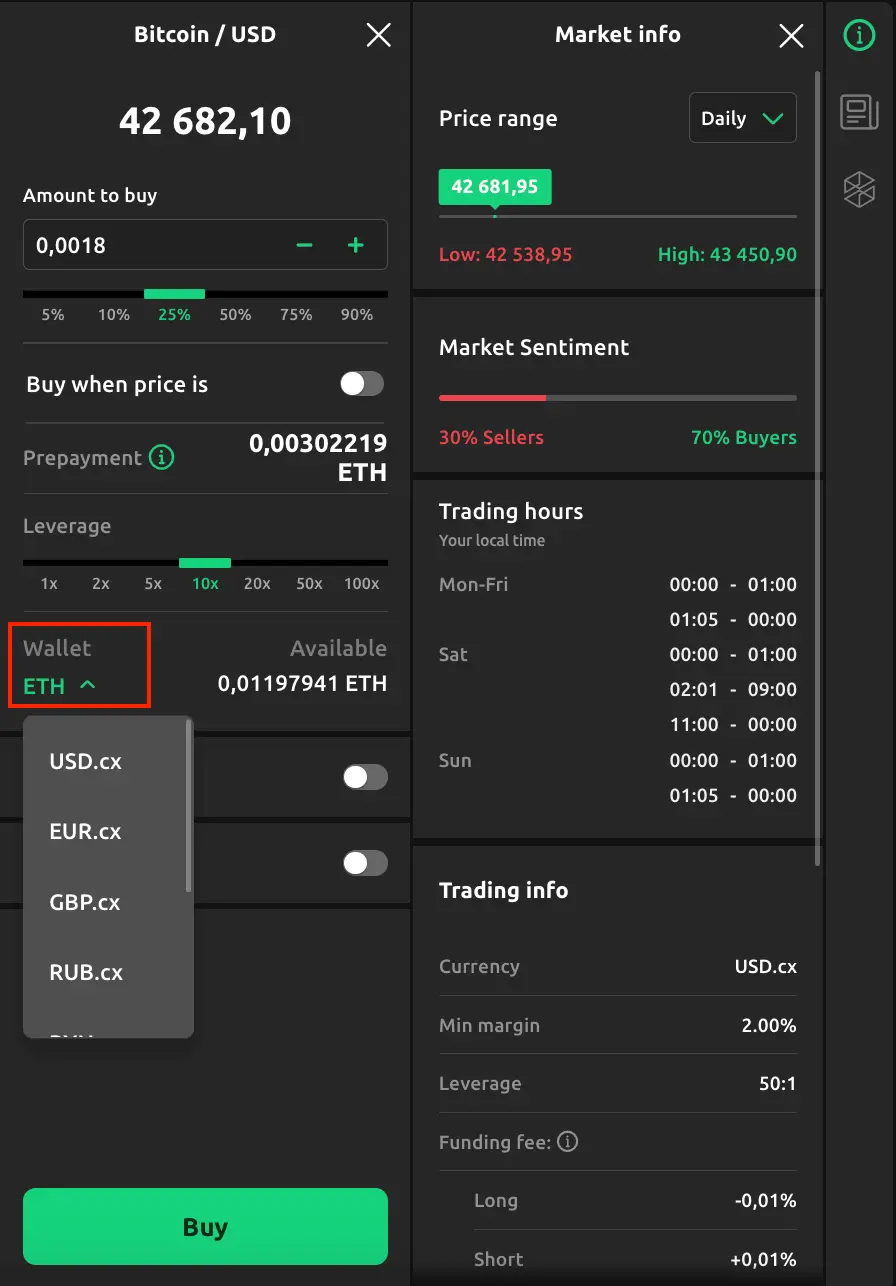

| Wallet usage | You can conduct an order only with the usage of the wallet in which the chosen by you tokenised asset is listed. | Here you can use all the available as collateral wallets for any chosen tokenised asset. Available wallets: BTC, ETH, USD.cx, EUR.cx, GBP.cx, BYN.cx. |

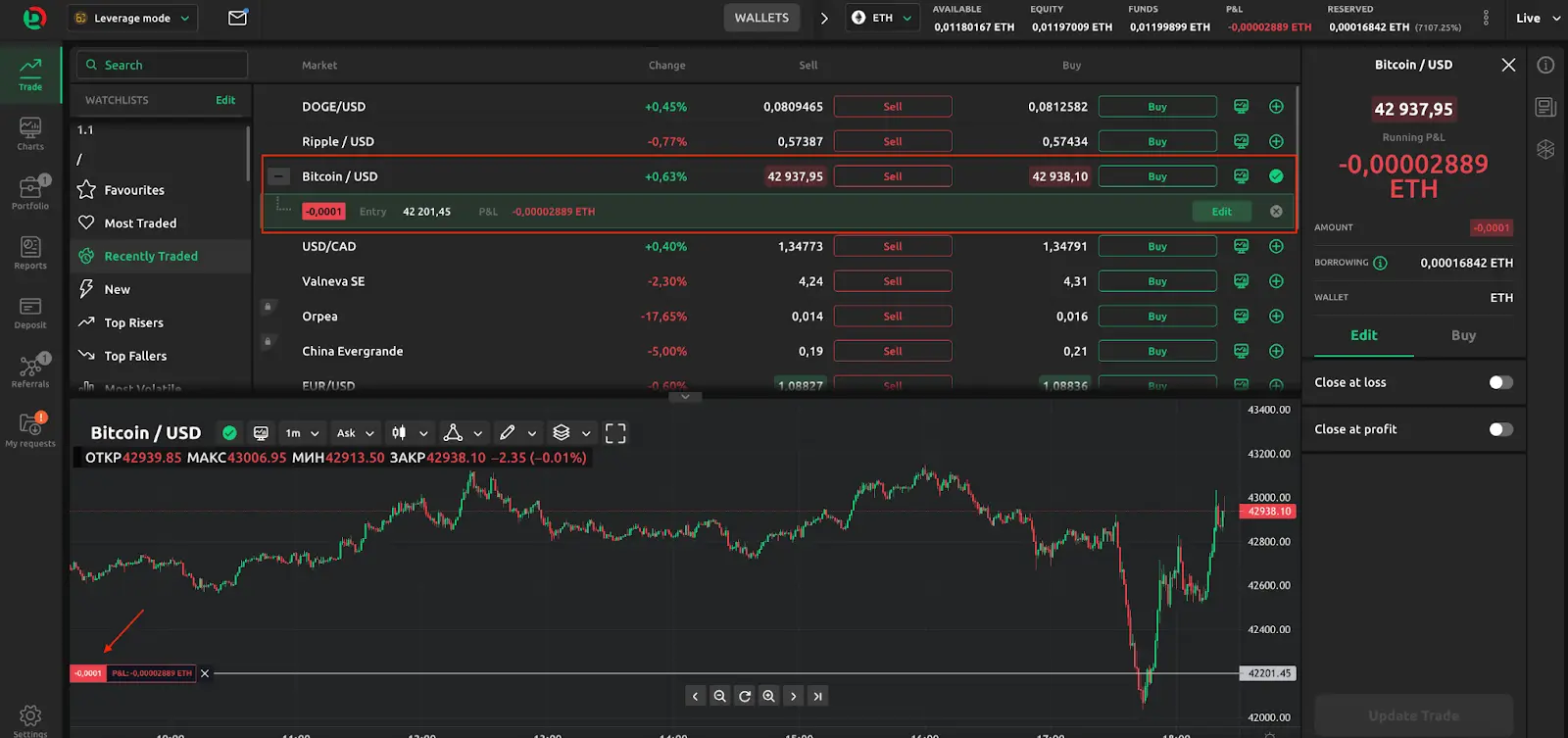

| Portfolio section | All the prior-bought tokenised assets can be seen in the ‘wallets’ section. | Only сurrent leverage trades can be seen in this section. |

| P&L balance indicator | There is no opportunity to see your current P&L. | P&L is shown only for current leverage trades. |

| Chart trading | No opportunity to use chart trading. | Stop loss and take-profit levels for particular trade or order can be changed in the edit mode. |

| Price alerts (MOB) | No opportunity to set price alerts. | Price alerts can be set only in the leverage trading mode. |

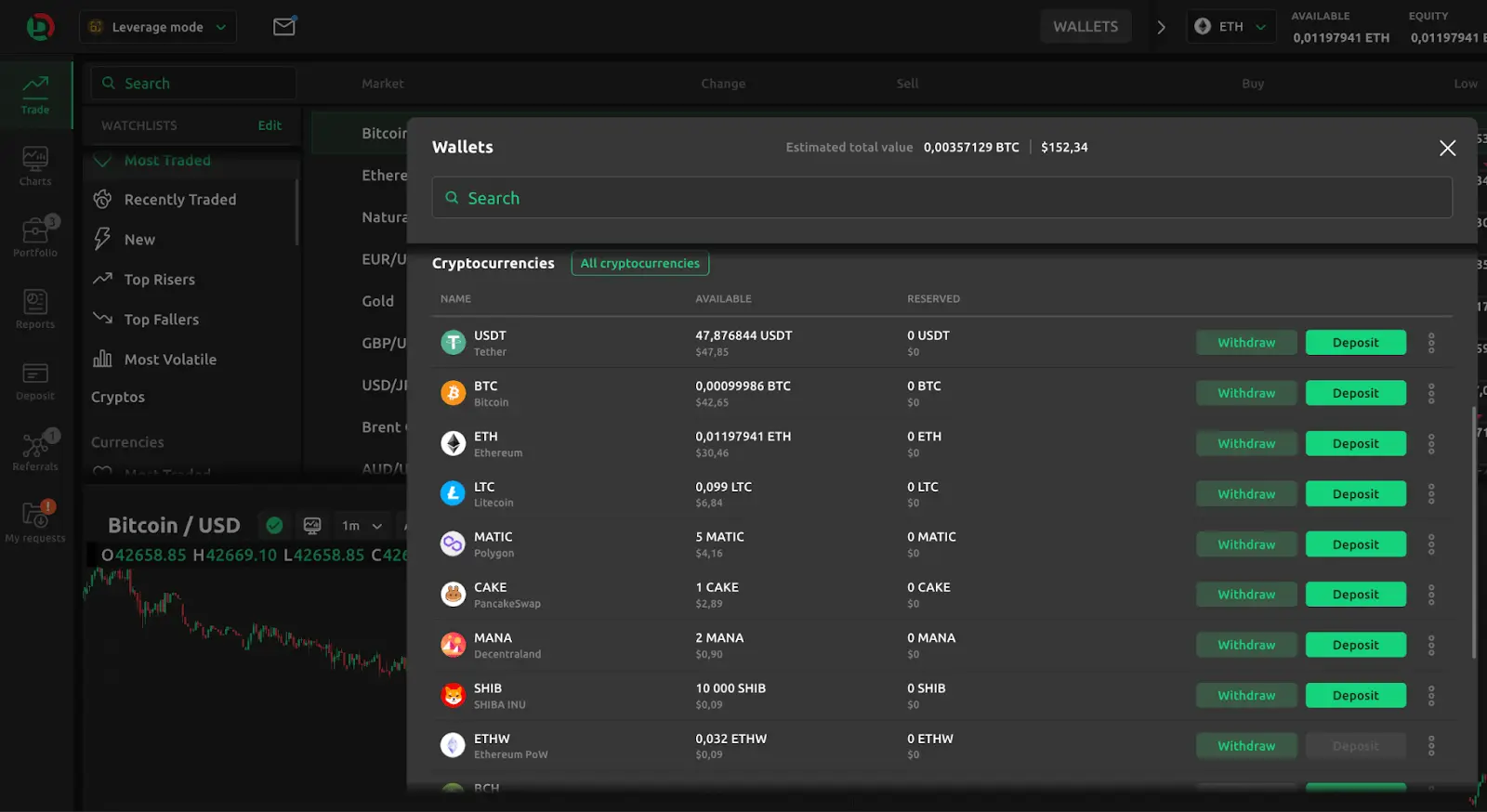

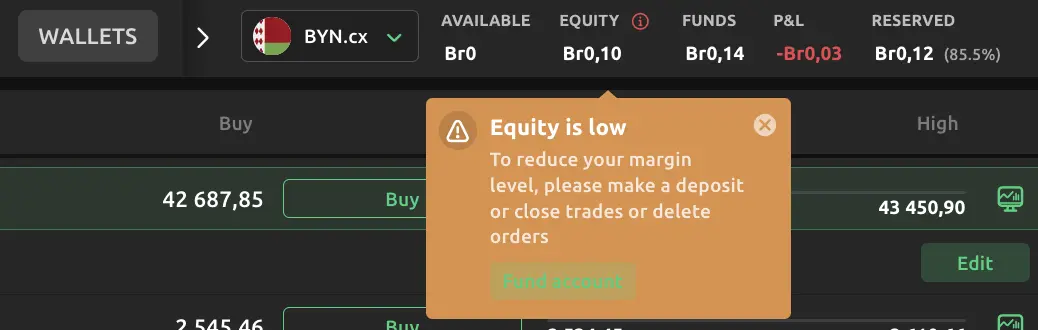

Wallet values explanation

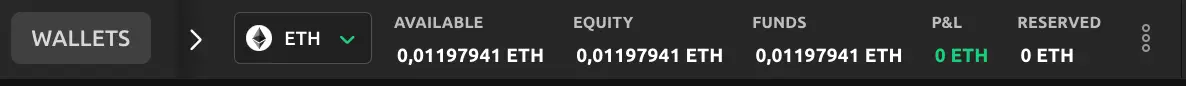

Wallet section consists of 5 indicators each of which has a unique calculation formula:

- "Funds" - balance available after closing all the trades; sum of capital without taking into consideration active leverage trades P&L;

- "P&L" - profit or loss on active leverage trades;

- "Equity" = Funds + P&L, this indicator shows the sum of deposited funds, (un)realised profit or loss accept prior taken fees and withdrawals;

- "Reserved" - sum of funds taken as a reserve for any kind of orders in the "leverage" trading mode as well as for the limit orders in the 'exchange' trading mode.

"Leverage" trading mode: Reserved = Current tokenised asset price (bid or ask depending on the trade direction) * Qty / leverage size;

- "Available" = Equity - Reserved; sum of money which is currently available for withdrawal.

A final formula is the following: Equity = Available + Reserved = Funds + P&L.

Please note that balance indicators depend on the wallet you chose.

Order types

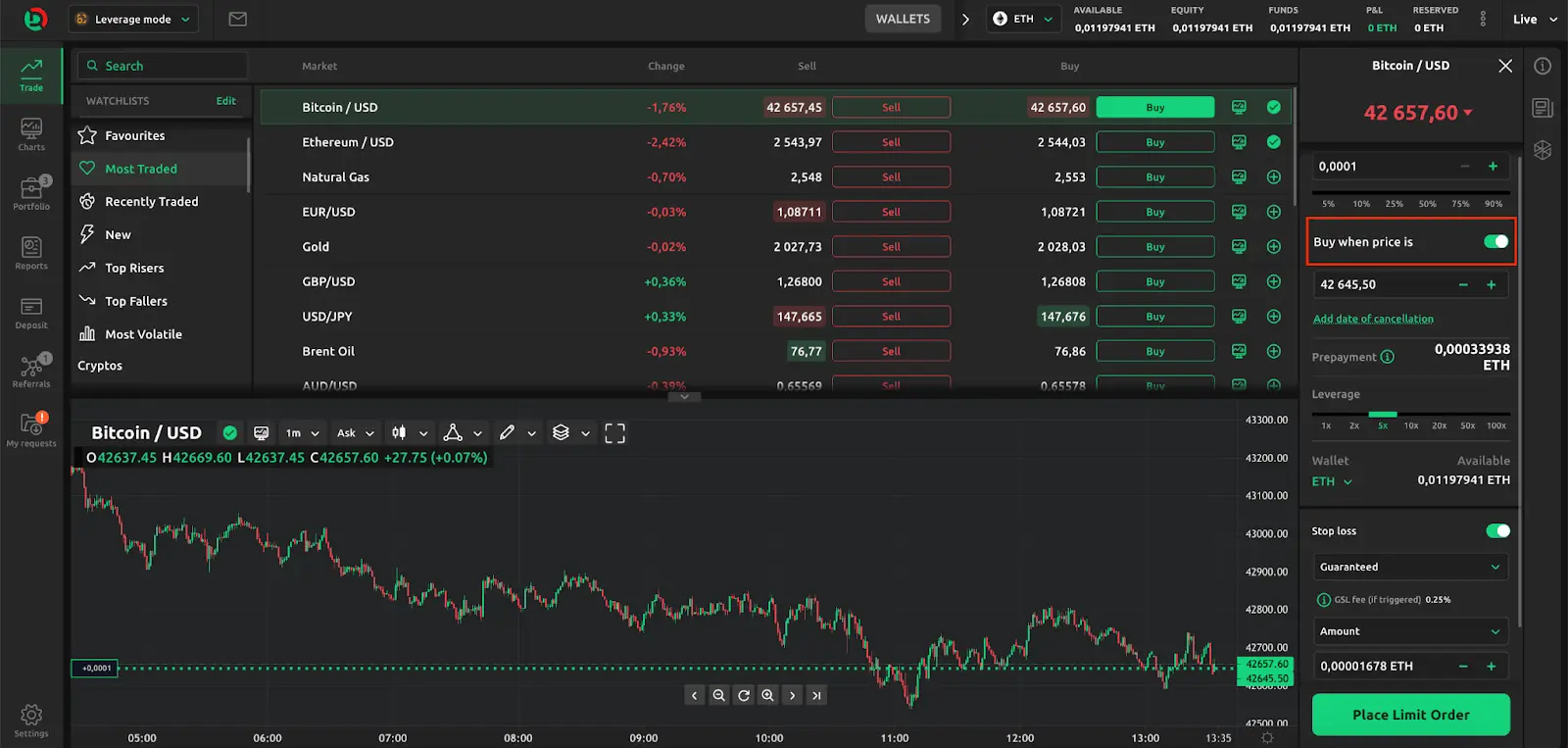

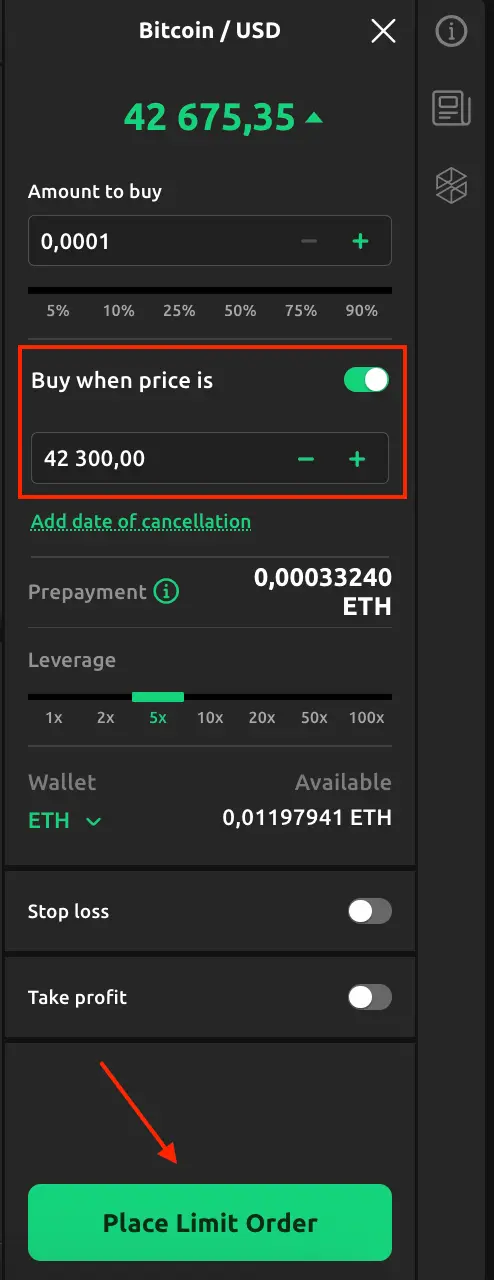

Limit orders

Limit order is an order which helps you to buy or sell a corresponding tokenised asset for the price you set. Please note that for the limit order you should set a price which is better than the current one. For buy limit order the price should be lower than current and for the sell limit order - higher than current.

Limit order guarantees price but doesn’t guarantee an execution which means that in case of a price gap an order will be executed strictly according to the mentioned price and can be partially filled.

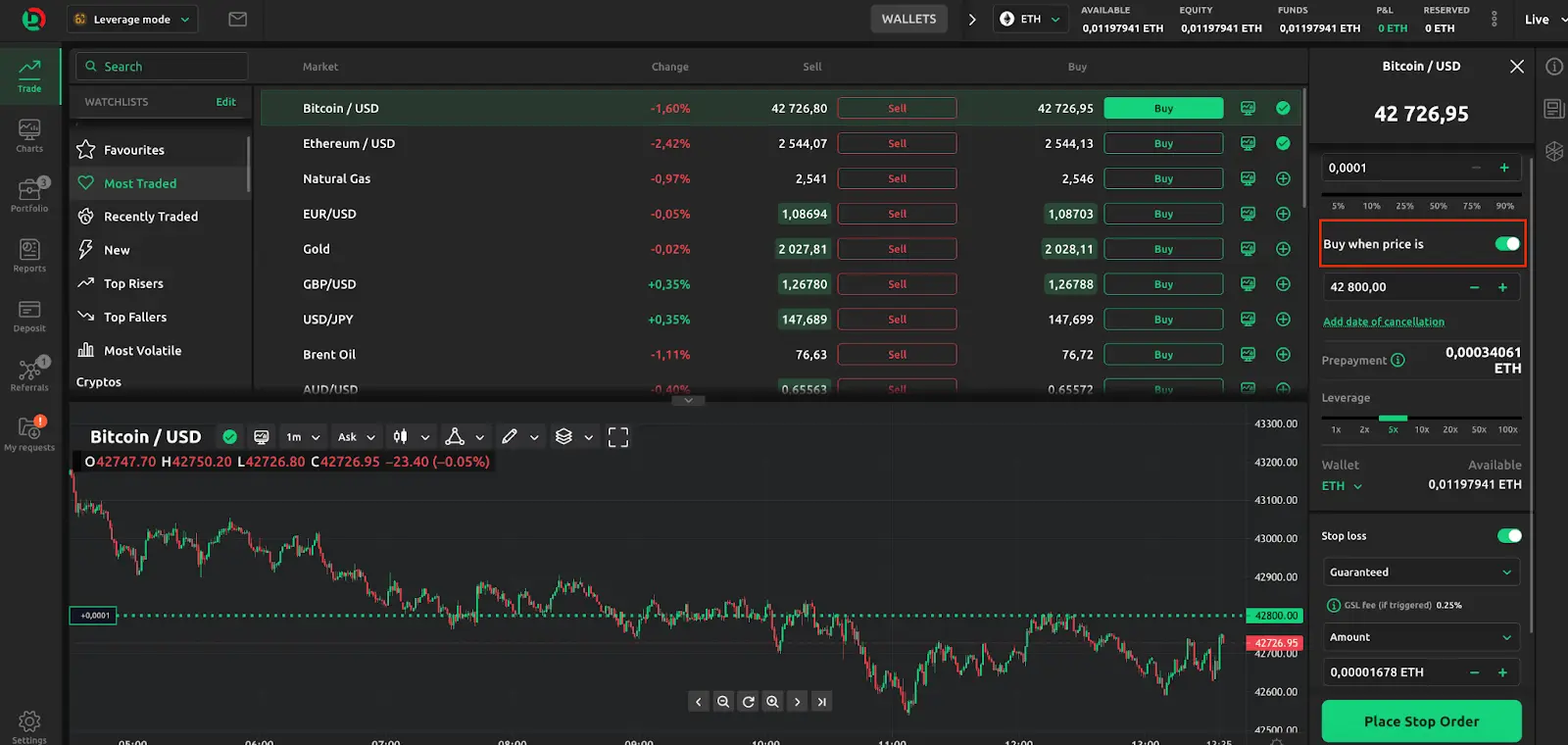

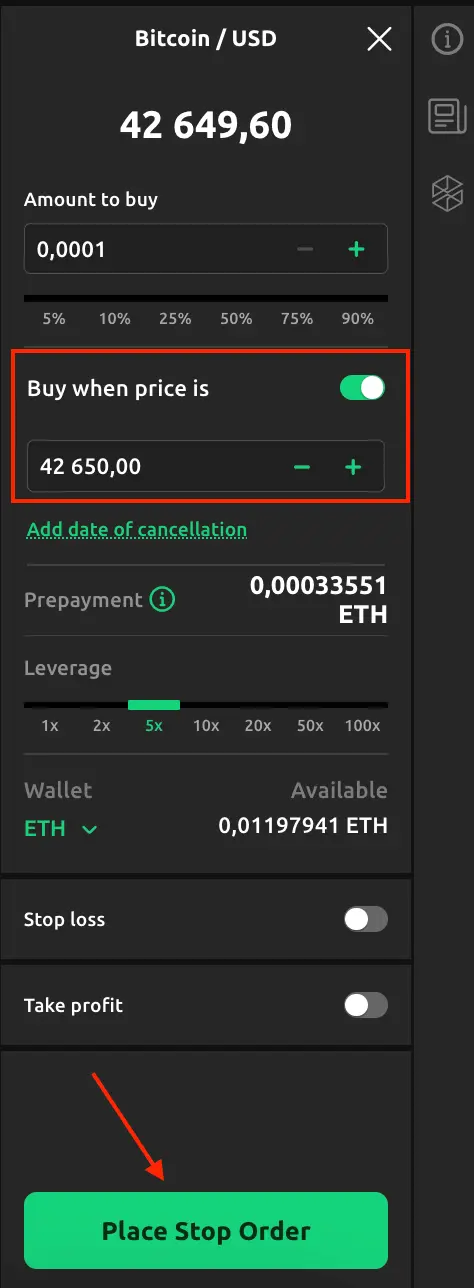

Stop orders

Stop order (buy stop or sell stop) helps you to buy or sell a tokenised asset at a pre-set price which is worse than the current price. For the buy stop order a higher price should be mentioned and for the sell stop order a lower price is to be set.

Please note that stop orders are available only within leverage trading mode and in case you try to set a stop order in the exchange trading mode it will be executed in accordance with the current tokenised asset price.

Stop order (together with stop loss) guarantees execution but doesn’t guarantee price. In case there is a price gap, stop order will be executed at the first available price after the gap.

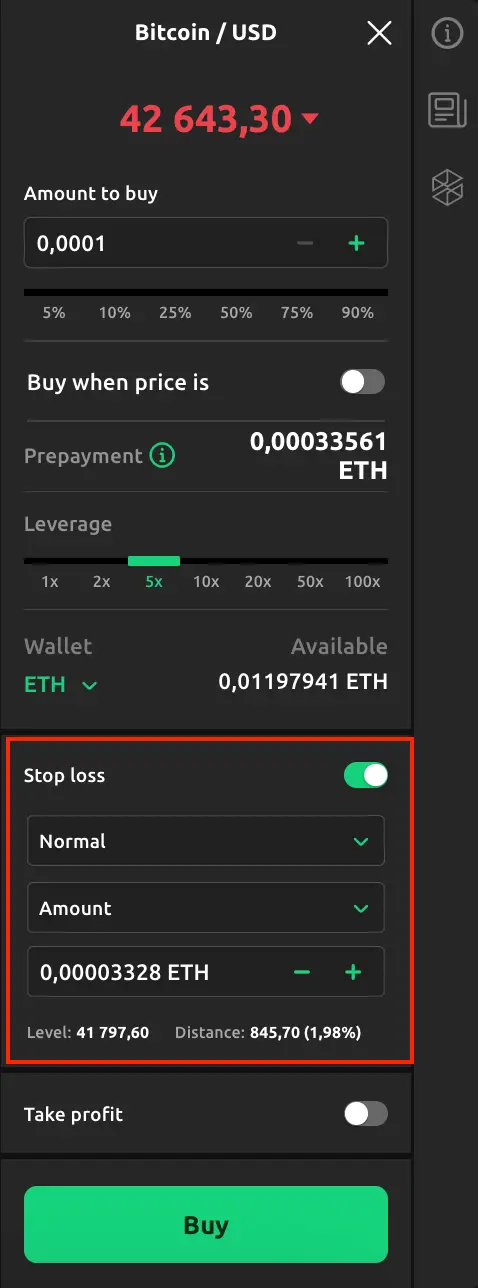

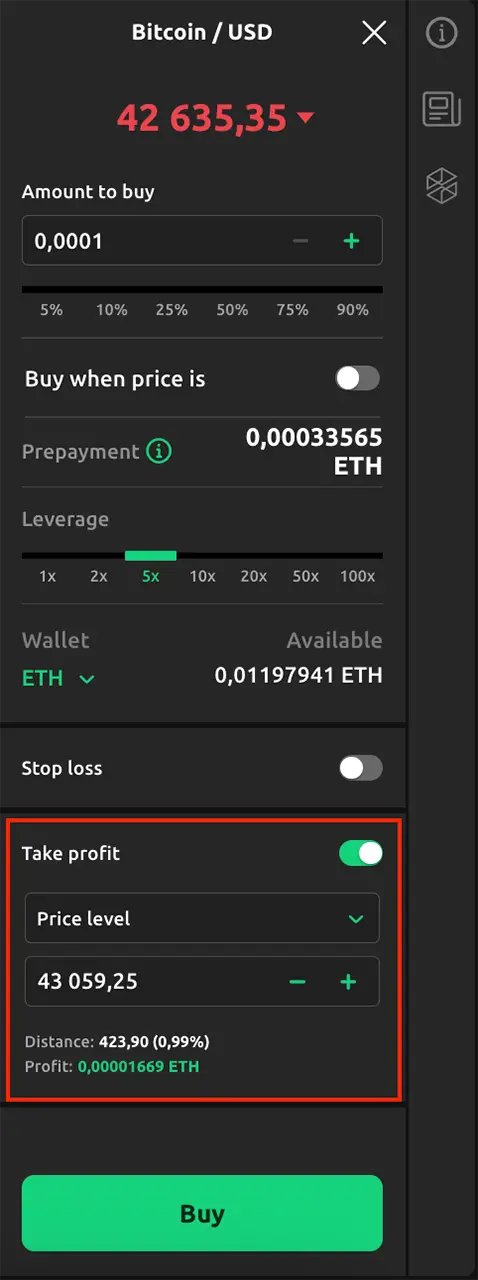

Stop loss and Take profit

These settings help you to limit your losses or fix profits by specifying the price you want your order to be closed at. Please note that take profit behaves as a limit order and can be partially filled.

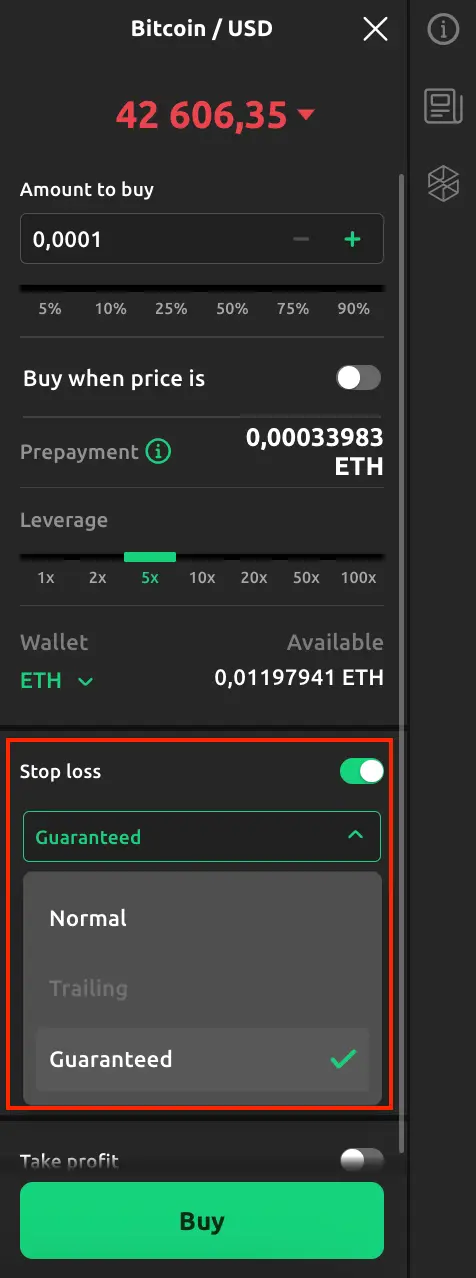

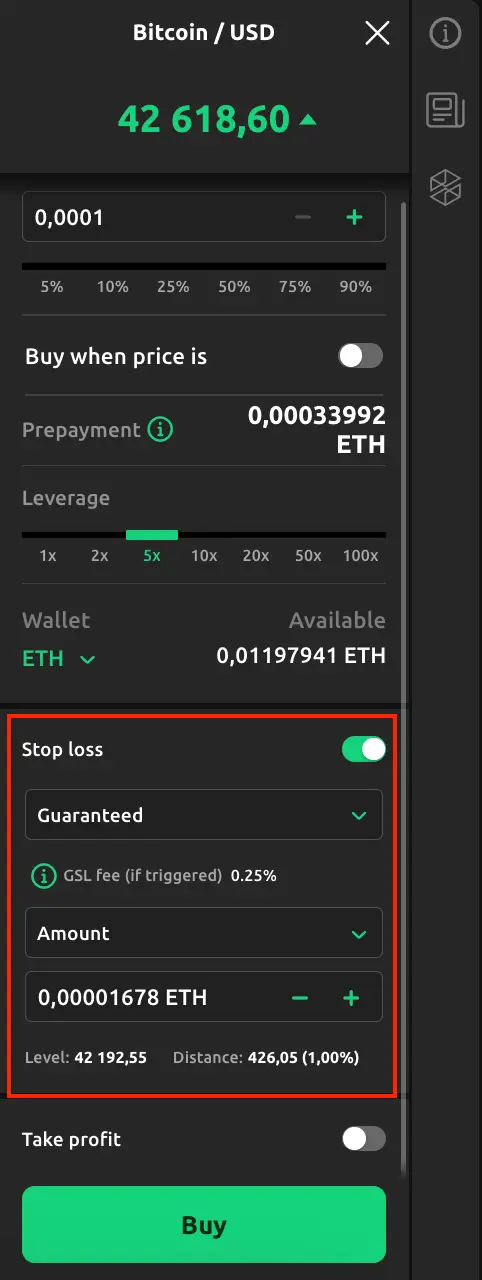

Guaranteed stop loss

Guaranteed stop loss works the same way as the stop loss except that it guarantees to close out a trade at the price specified, regardless of market volatility or gapping. If the condition "Guaranteed stop loss" has been met, the client will be charged an additional fee. The size of the additional fee may vary depending on the instrument and is indicated in the special interface window.

Please note that in most of the cases you can choose which stop loss should be set but for ETH/USD, BTC/USD, ETH/EUR and BTC/EUR you can set a 1:50, 1:100 leverage only with a guaranteed stop-loss embedded.

Also it should be noticed that ‘Reserved’ balance indicator is calculated in 2 different ways depending on the way of setting a Guaranteed stop loss order.

GSL set by client's wish

Reserved funds = Trade volume / Leverage size + Trade volume * GSL fee;

Trade volume = Tokens quantity * Price.

An embedded guaranteed stop-loss for 1:50, 1:100 leverage sizes with ETH/USD, BTC/USD, ETH/EUR and BTC/EUR

Reserved funds = (Current price - Price level) * Tokens quantity + (Current price * GSL fee * Tokens quantity)

Differences between Stop Loss and Guaranteed stop loss

Guaranteed stop loss guaranteed an execution at the price you set price when a stop order guarantees execution but doesn’t guarantee price.

In order to understand the difference better please have a look at the following example.

The client bought 2 Aaa.cx tokenised shares at the price of 95 USD.cx with a leverage of 1:x. Also a stop loss level at 60 USD.cx asset price was set (which is equal to 70 USD.cx of loss).

The next day as soon as the market opened the tokenised share price was equal to 50 USD.cx with a corresponding price gap to take place.

Let’s have a look how the trade will be closed shortly after the market is opened in different situations:

- Client set a simple stop loss

The trade will be closed in accordance with the first available price in the corresponding order book (let’s assume it is equal to 50 USD.cx). The client will face a loss of 100 USD.cx instead of 70 USD.cx;

- Client set a Guaranteed stop loss

The trade will be closed at a price of 60 USD.cx (even in case there won’t be such a price in the order book) and an additional fee will be taken from his/her account balance (note that fee sizes differ depending on the chosen tokenised asset). The client will have 70 USD.cx and fee losses.

Differences in order types in accordance to the chosen trading mode

| Order | Exchange trading mode | Leverage trading mode |

|---|---|---|

| Market order | Yes | Yes |

| Limit order | Yes | Yes |

| Buy stop / sell stop | No | Yes |

| Stop loss and take profit | No | Yes |

| Guaranteed Stop Loss | No | Yes |

Margin call, closeout and liquidation levels

A margin call warning is a reminder we send when the amount of margin for long-operations and short-operations (prepayment) becomes insufficient to maintain current transactions and other orders.

Levels:

- If your equity falls below 100 per cent of the required prepayment, you’ll receive our first margin call warning. You will no longer be able to open new trades or place orders.

- If your equity goes below 75 per cent of the prepayment, you’ll receive the second margin call warning. You will still not be able to open new trades or place orders.

- If the equity is equal to or less than 50% of the required prepayment, it means you have reached the minimum-allowed prepayment level and your trades will be gradually closed out.

Once the client’s equity drops below 50% of the prepayment (Reserved), the trades will be closed out in the following order:

- At first, Good-Till-Cancel (GTC) orders are closed;

- If the prepayment level remains below 50%, all losing open trades on the open markets are closed;

- If the prepayment level is still below 50%, the remaining trades on the open markets are closed;

- If the prepayment level stays below 50%, all the remaining trades are closed as soon as the markets are open.

Example

The client decided to open a buy leverage trade for ‘2’ A.cx with 5x leverage size and an asset price of 300 USD.cx.

Reserved = current price * Qty / leverage.

| Comments | Available | Equity | Funds | P&L | Reserved | Equity / reserved | Margin call and close out |

|---|---|---|---|---|---|---|---|

| Prior to trade | 300 | 300 | 300 | 0 | 0 | – | – |

| Once the trade is conducted | 180 | 300 | 300 | 0 | 120 | 250% | – |

| The price dropped by 50 USD.cx | 100 | 200 | 300 | -100 | 100 | 200% | – |

| The price dropped by 120 USD.cx | 0 | 60 | 300 | -240 | 72 | 83,3% | 1st margin call warning (<100%) |

| The price dropped by 125 USD.cx | 0 | 50 | 300 | -250 | 70 | 71,4% | 2nd margin call warning (<75%) |

| The price dropped by 133,3 USD.cx | 0 | 33,4 | 300 | -266,6 | 66,68 | 50% | Start of gradual close out |

| The client doesn't have any conditions for gradual close out. | 33,4 | 33,4 | 33,4 | 0 | 0 | – | Close out took place |