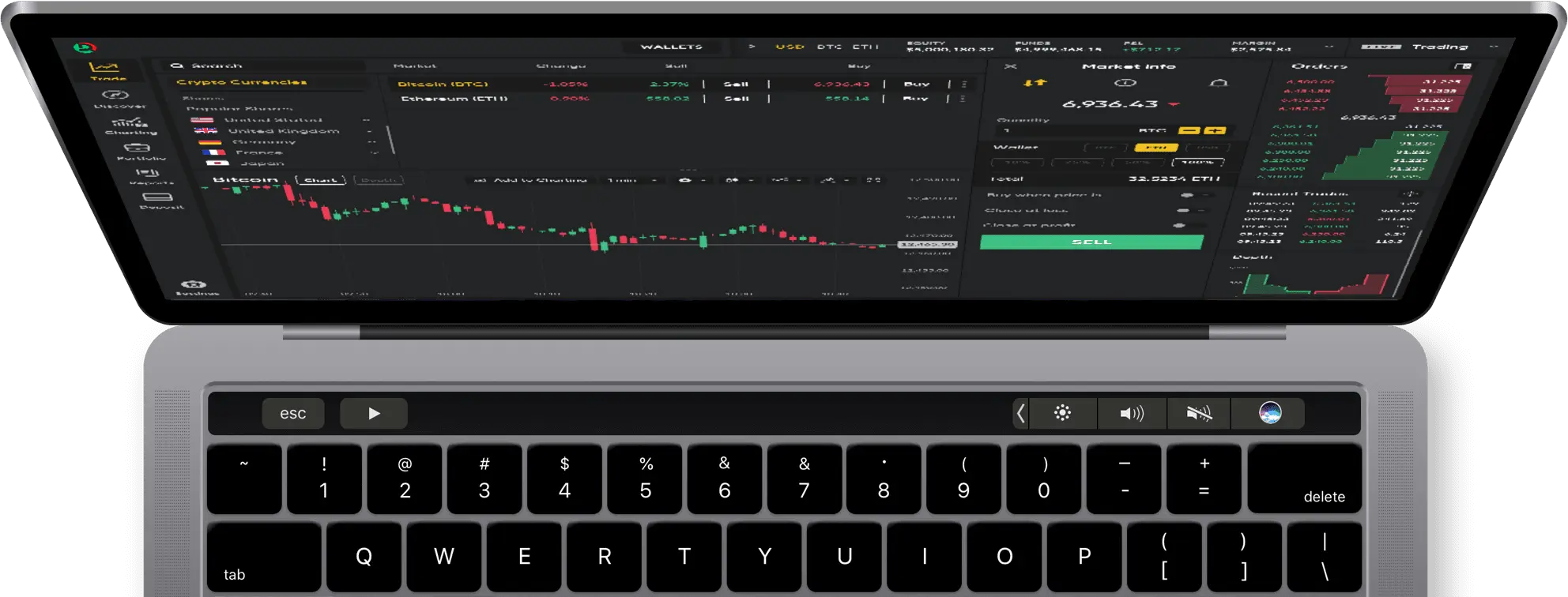

Crypto as collateral. Trade the global financial markets using Bitcoin or Ethereum.

Our advanced web platform is the first regulated tokenised assets exchange in Belarus.

Make a move on the price action of the world's biggest companies using tokenised assets.

| Icon | Name* | Sell | Buy | Chart(2d) |

|---|---|---|---|---|

|

TSLA Tesla Inc |

439.54 | 439.68 | ||

|

NVDA NVIDIA Corp |

188.55 | 188.79 | ||

|

LAZR Luminar Technologies Inc |

0.16 | 0.21 | ||

|

INTC Intel Corp |

39.41 | 39.54 | ||

|

UVXY ProShares Ultra VIX Short-Term Futures ETF |

34.75 | 34.91 | ||

|

PLTR Palantir Technologies Inc |

168.61 | 169.63 | ||

|

COIN Coinbase Global Inc |

236.80 | 237.87 | ||

|

AMZN Amazon.com Inc |

226.48 | 226.66 | ||

|

NFLX Netflix Inc |

90.99 | 91.08 | ||

|

MARA Marathon Digital Holdings, Inc |

9.87 | 9.94 | ||

|

HOOD Robinhood Markets Inc |

115.28 | 115.62 | ||

|

AMD Advanced Micro Devices Inc |

223.38 | 224.04 | ||

|

MU Micron Technology Inc |

317.09 | 318.40 | ||

|

BYND Beyond Meat Inc |

0.85 | 0.91 | ||

|

GOOGL Alphabet Inc - A |

314.74 | 315.37 | ||

|

TQQQ ProShares UltraPro QQQ |

52.33 | 52.46 | ||

|

AG First Majestic Silver Corp. |

16.04 | 16.09 | ||

|

XPEV XPeng Inc - ADR |

20.35 | 20.52 | ||

|

MSFT Microsoft Corp |

472.53 | 472.77 | ||

|

PLUG Plug Power Inc |

2.20 | 2.26 | ||

|

AAPL Apple Inc |

270.89 | 270.98 | ||

|

GTLB GitLab Inc. Class A Common Stock |

36.14 | 36.37 | ||

|

META Meta Platforms Inc |

649.68 | 650.36 | ||

|

DJT Trump Media & Technology Group |

13.74 | 13.81 | ||

|

SOFI SoFi Technologies, Inc. |

27.42 | 27.53 |

Our advanced web platform is the first regulated tokenised assets exchange in Belarus.

Crypto as collateral. Trade the global financial markets using Bitcoin or Ethereum.

Security as priority. The safety of your holdings is guaranteed in accordance with the legislation of the Republic of Belarus.

Technical indicators. Keep an eye on your positions with over 75 advanced charts, price analysis and price alerts.

Control your capital. Use stop-loss and take-profit orders to keep what you earn.

Use the world’s first regulated tokenised assets exchange to build a diverse investment portfolio with your crypto holdings. Make your deposits in Bitcoin or Ethereum to trade global financial instruments with competitive leverage and tight spreads. Dzengi.com keeps your holdings secure and accessible at a glance.