Read our guide to the Williams Fractal indicator and learn how it helps determine trading signals and alerts

Contents

- What is Williams Fractal trading indicator?

- How to use Fractal indicator

- How to use fractals in trading

- Advantages of Fractal trading indicator

- Drawbacks of Williams Fractal indicator

- FAQs

What is Williams Fractal trading indicator?

Williams Fractal or fractals is a technical analysis indicator introduced by the famous trader Bill Williams in his book ‘Trading Chaos’. He developed it on the basis of the Chaos Theory and trading psychology. The indicator is centred around the idea that there is repetition in price behaviour and fractals can provide an insight into those repetitive patterns.

The indicator usually looks like a five bars model, which is used to identify possible reversal points and detect the direction of the price movement.

How to use Fractal indicator

In order to detect a fractal formation or employ a Williams Fractal strategy, look at five successive price bars where the third (or the middle) bar represents the highest high or the lowest low.

Keep in mind that the Fractal trading indicator arrow appears only above or below the third candlestick if it is the highest or the lowest of the five bars. Also, according to Williams, you don’t have to incorporate five bars to create a fractal.

On your trading platform, the Williams Fractal trading indicator is displayed as arrows located immediately above or below the price bars on the chart.

The arrow above the candlestick is called the buy fractal and the arrow below the candlestick is called the sell arrow.

The first one is called a buy arrow because it serves as a resistance, meaning that when the price moves beyond this level a buy signal will occur.

The sell fractal acts as a support level and price moving below this fractal can indicate potential sell opportunity. Noteworthy is that the Fractal indicator can provide more reliable alerts on higher time frames, but it will also display fewer signals.

How to use fractals in trading

Although some consider the Fractal trading indicator as being outdated for today’s markets, the Williams Fractal formula is still heavily used by traders. The indicator is a handy tool for defining your trading strategy and it can be used as follows:

- For detection of potential stop-loss levels.

- They can act as a support and resistance levels.

- To determine the highs and lows.

- Signal potential entry points.

- To be applied together with Fibonacci retracement levels.

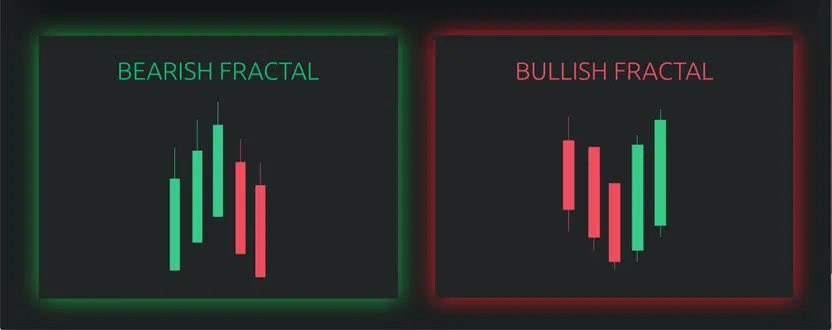

Before we take a closer look at them, let’s make one important aspect clear. The naming of the up and down fractals may be a bit confusing for traders. The reason is that the down fractal is referred to as bullish and the up fractal is called bearish.

Look at the example of bearish and bullish fractal in the next image. A bearish fractal is formed when the middle price bar displays the highest high compared to the two bars to the left and right, which have lower highs.

It is called a bearish fractal because although the fractal points up, it is followed with a price decline. The bullish fractal, on the other hand, is detected when the middle bar has the lowest low compared to the bars on either side.

You should generally be looking for a nearly perfect fractals structure (similar to the ones presented above) because the fractals can appear in different formations with different lengths of the bars on either side. The fractal structure can also depend on the underlying asset.

Now, coming back to the question of the fractals application. One option is to determine potential stop-loss levels. You will set your stop loss level when entering a short position at the top of your last fractal. Conversely, a stop loss for a long position will be set at the bottom of the last fractal.

Also, the Williams Fractal trading strategy can include the Fibonacci retracement levels. Applying the fractals will enable you to reject potential levels that may prove to be misleading because you will execute a trade solely at the levels where the fractal reversal appears.

You can use fractals to determine potential breakouts by looking at the position of the current fractal compared to the previous fractal. Williams states that when the price moves one point or more, above or below the previous fractal, then this signals a potential breakout.

- A buy breakout appears when the price increases above the last upward fractal.

- A sell breakout occurs, if the price moves below the last downward fractal.

Williams alligator, another trading indicator, can help you clear out the signals detected with the fractals. Traders include it as part of their Williams Fractal trading strategy and look for buy and sell signals based on the position of the fractals in relation to a specific alligator line. Here is how it works:

- Place a buy order when the buy fractal is above the red line (the alligator’s teeth).

- Place a sell order when the sell fractal is detected below the alligator’s teeth.

As you can see, the Williams Fractal trading indicator can be applied in several ways. However, the way you use it depends exclusively on your personal preferences and trading strategies. Don’t forget to use the Fractal trading indicator in combination with other tools. You can also consider setting up fractals with different time frames and look for opportunities generated from shorter time frames while the longer time frame fractals will act as a filter of the shorter frame signals.

Advantages of Fractal trading indicator

- Once the trader grasps the notion behind Fractal trading indicator it is rather simple to use and to identify potential trading signals and other types of alerts.

- Except for the highs and lows, a fractal indicator also shows potential support and resistance levels of buy and sell positions.

- You can use fractals as an additional indicator when determining the trends.

- Identification of potential breakouts.

Drawbacks of Williams Fractal indicator

- The Fractal indicator will lag by a couple of bars because at least two closed bars are needed for a fractal to be completed, meaning that when it provides a signal, the price may be at another level compared to the signal.

- Fractals trading is recommended during the trending market, but you should avoid using the indicator during a sideways moving market.

- Traders should pay close attention to the fractals formation as some of them may provide misleading signals.

FAQs

The indicator usually looks like a five bars model, which is used to identify possible reversal points and detect the direction of the price movement. To detect a fractal formation or employ a Williams Fractal strategy, look at five successive price bars where the third (or the middle) bar represents the highest high or the lowest low. The Fractal trading indicator arrow appears only above or below the third candlestick if it is the highest or the lowest of the five bars.

The Fractal indicator will lag by a couple of bars because at least two closed bars are needed for a fractal to be completed, meaning that when it provides a signal, the price may be at another level compared to the signal.

Although some consider the Williams Fractal trading indicator as being outdated for today’s markets, the Williams Fractal formula is still heavily used by traders. The indicator can be a handy tool for defining your trading strategy by detecting the potential of stop-loss levels and to act as a support and resistance levels.