If you want to learn how to trade Ethereum, we can help

Contents

- Learn how to trade Ethereum

- How to trade ETH: what drives prices

- Ethereum trading: top techniques

- How to trade Ethereum: top tips for success

It is a good time to learn how to trade Ethereum, or ether (ETH), to give it its proper name, the currency of the Ethereum blockchain. This blockchain has benefited from the crypto boom of 2021. Ether’s value improved by more than 900% between November 2020 and November 2021. It remains the second biggest coin, and with its starring role in the decentralised finance ecosystem, it is not going away. In this guide on how to trade Ethereum, we will look at some leading Ethereum trading strategies and explore factors that drive prices.

Learn how to trade Ethereum

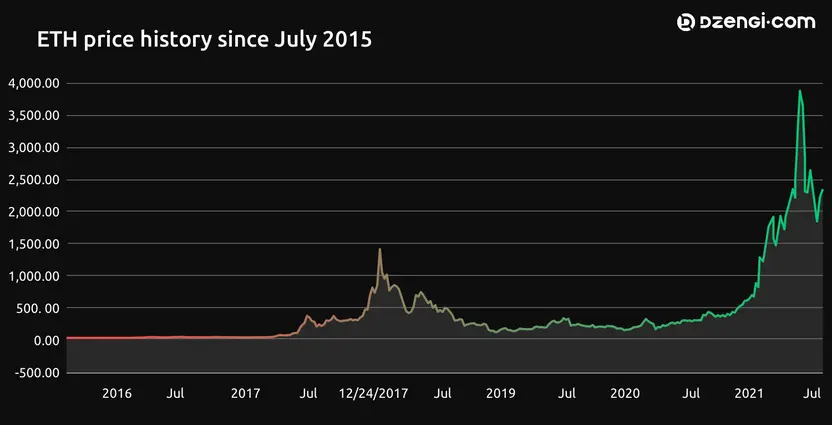

Ethereum launched in 2015, six years after Bitcoin (BTC). Ethereum trading has had plenty of highs and lows since then, as this price history chart shows.

Ethereum made a hard fork into two separate blockchains: Ethereum and Ethereum Classic, after a flaw on the digital autonomous organisation (DAO), a platform for people to raise money for their start-up apps, meant a hacker tried to steal millions of dollars’ worth of ETH in 2016. Since then, the new blockchain has cemented its position as home to the world’s second-largest cryptocurrency in terms of market capitalisation. One thing to remember as you discover how to trade Ethereum is that Ethereum and Ethereum Classic are separate cryptos.

One metric to watch as you learn how to trade ether is this coin’s strength against BTC. On 15 November 2020, one bitcoin was the equivalent of 35.62 ETH, but 12 months later the same exchange cost just below 14 ETH.

When figuring out how to trade Ethereum, look at how it is doing in relation to other cryptocurrencies, not only BTC.

How to trade ETH: what drives prices

Understanding themes that have helped ETH grow in the past can inform your Ethereum trading techniques. Being able to interpret charts and data, and spot trends, increases the chance of executing a successful trade.

Ethereum trading: top techniques

ETH can be traded 24 hours a day against cryptocurrencies and fiat money. Because the market never sleeps, some traders use stop losses and take profit orders so their positions are exited automatically when a certain price level is reached. Whether this Ethereum trading strategy is for you depends on your research and your attitude to risk.

Others use trading bots to achieve their goals. Although bots can do some of the work, it is crucial to ensure that the tools you use are dependable. A bot is never a replacement for human involvement.

A common approach to ether trading involves contracts for difference (CFDs), a derivative where you do not end up owning the cryptocurrency. Instead, you enter an agreement with a broker based on whether you think the price of ether will go up or down. If you adopt a long position as your ether trading strategy and ETH’s price rises, the broker will pay you the difference in price from the start to the end of the trading session. But if prices fall, you will make a loss and have to pay the broker. Through CFDs, it is also possible to take short positions and speculate on whether ETH will fall.

If you are looking for a more long-term ether trading strategy, you might choose to buy ETH and hold it in the anticipation that prices will rise. A range of products are beginning to hit the market, such as futures and options, which can help a trader shield themselves against volatility.

If you are wondering where to trade Ethereum, most cryptoexchanges will do it, including Dzengi.com

How to trade Ethereum: top tips for success

Now that you know a little more about how ether trading works and how to trade ETH, here are a few tips that can increase your chance of success.

- Read everything: Research is crucial before you enter into Ethereum trading positions. Tweets from analysts and coverage from specialist news sites can be exceedingly helpful as you try to determine which way the market is heading. Just make sure that you take information from a diverse range of sources. It is all too easy to get sucked in by bulls apparently convinced that ether is going to soar.

- Think ahead: Work out strategies in advance. What is your best outcome? What profit are you aiming at? How much are you prepared to lose? A trader should be wary of allowing emotions to take over. Failing to exit at the right time can exacerbate losses substantially, something you want to avoid as you get acquainted with how to trade ETH.

- Be cautious: Many exchanges now offer the ability to trade on margin. For example, you can enter into a $500 position by putting up just $100 in capital. Although this would amplify any profits five times over, it could also result in heavy losses.

And, finally, remember never to invest more than you can afford to lose.