The Choppiness index helps traders distinguish between trending and consolidating markets

What is the Choppiness index indicator?

The Choppiness index (also called CI or CHOP) is a volatility indicator developed by E.W. Dreiss, an Australian commodity trader. As a technical indicator, the Choppiness index examines whether the market is moving up or down or not moving in a particular direction (choppy market). While other indicators may illustrate the direction of the price, the Choppiness index is a directionless indicator.

The Choppiness index falls in the category of range-bound oscillator indicators and it can take values of between 0 to 100. Low values will point toward possible trending movement, whereas higher values indicate consolidation or sideways movement. The Choppiness index formula is based on the true range values for a specific number of periods.

Reading the CI indicator values, traders commonly use Fibonacci ratios to serve as a threshold. The Fibonacci ratios, which are part of the Fibonacci retracement levels, are derived when the number from a Fibonacci sequence is divided with a number that follows or a number that is two spots to the right. Each number in the Fibonacci sequence is obtained as the sum of the previous two numbers, as follows, 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, etc.

Hence, the ratio of 61.8% is calculated by dividing a number by the following number. For instance, 34 divided by 55 equals 0.618 or 61.8%. The lower threshold of 38.2% is calculated when a number is divided with the number that is two places to the right. For instance, 34 divided by 89 equals 0.382 or 38.2%.

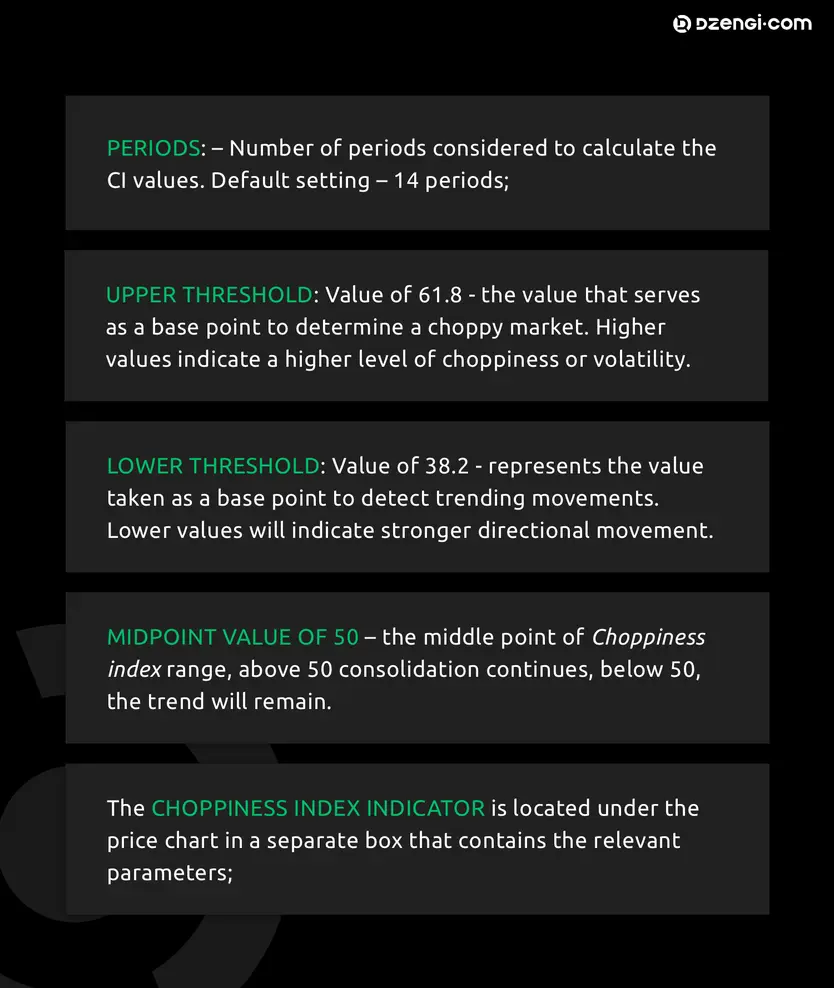

A Choppiness index value of 61.8 represents the upper threshold. A CI indicator with a value of 38.2 is set as a lower threshold. It may also be said that traders might also look at the midpoint of the CI range and evaluate the position of the blue line against the 50-value mark. The relevant parameters associated with the Choppiness index indicator and its set up on the trading platform are:

The following image gives an overview of a Choppiness index setup.

The CI indicator is the blue line oscillating within a range of 0 to 100, while traders should be aware of three parameters marked with white, red and yellow lines. The first point is the level, where CI takes a value of 61.8, which is a reference for increased choppiness. The bottom line is set at the level of 38.2 that shows the existence of a trend. The third line (red line) shows the location of the midpoint. The blue line may move above or below the selected levels for a more extended period.

How to use a Choppiness index indicator?

To know how to read the Choppiness index, traders should understand that this indicator doesn't provide signals about the price direction. As we have said, it gives indications for the existence of a trend or when the market moves sideways. The CHOP indicator should be used in combination with other technical indicators, such as RSI or moving averages, to confirm any detected signals and identify the price direction.

Traders might use the Choppiness index to examine whether a price movement will remain choppy based on the position of the CI line against the midpoint line. The setup is shown in the following graph.

Four areas are marked with yellow rectangles on the selected weekly chart. The two areas marked on the CI indicator setup show the points where the indicator line continually stays above 50, indicating a lack of trend. We can see that the price displays a sideways movement during the same period, which suggests that the market remains choppy.

Another Choppiness index trading strategy can be observed when traders use this indicator to identify potential breakouts. A breakout occurs following a period the price stayed inside a range or it was consolidating for a certain period. When the price moves outside of the range, it is said that it breaks out and will form either new highs or new lows depending on the direction of the breakout.

After the market has been moving sideways for an extended period, it will make a breakout. Also, it is anticipated that a trending movement over a certain period will come to an end and consolidation may start. A potential breakout setup is presented in the chart below.

We can see that the price moves sideways for a couple of months and the Choppiness index takes the value of above 61.8 on a couple of occasions while it maintains its value above the midpoint value of above 50. At some point, the CHOP indicator starts to move downward, crosses below the value of 38.2 and takes even lower values while remaining under the 50-value mark. At the point where the CHOP breaks below the lower threshold, the price breaks the range-bound movement and starts a trending movement.

Some traders may also look at the peaks or bottoms achieved by the CHOP line to identify potential signals. This is in a way that they might look for consecutive peaks and bottoms which haven’t moved beyond the upper or lower threshold of the CHOP indicator and determine whether the price movement will come to an end and reversal will occur or not.

Of course, such signals largely depend on the pattern formed with each individual asset and may not be generalized as a rule of thumb.

The CHOP indicator is a useful indicator to identify the way in which an asset's price moves or to confirm the existence or absence of a trend. The features of this indicator makes it useful for trend traders as well as range-bound trading strategies. However, traders should not neglect some of the limitations of this indicator.

Because it is based on past data, it shows what happened with the price in the past, which means that CI doesn't predict future price movements. Also, CI cannot be used as a stand-alone indicator for trading purposes. Still, it could be highly productive in combination with price action and momentum, volume or trend indicators.

FURTHER READING: How to read and use the Directional Movement Indicator?

FURTHER READING: Aroon indicator explained: How to read it and how to use it