Want to discover how to trade Litecoin? Check out our guide on how it works and how it compares against its rivals

Welcome to our shiny guide on how to trade Litecoin.

Given the countless thousands of cryptocurrencies out there, you might be wondering what makes this digital asset different from Bitcoin. Well, transactions tend to be a lot faster on its blockchain as blocks are typically verified in under three minutes. Another important thing to remember when Litecoin trading is that LTC has a much bigger supply than BTC, 84 million compared with 21 million.

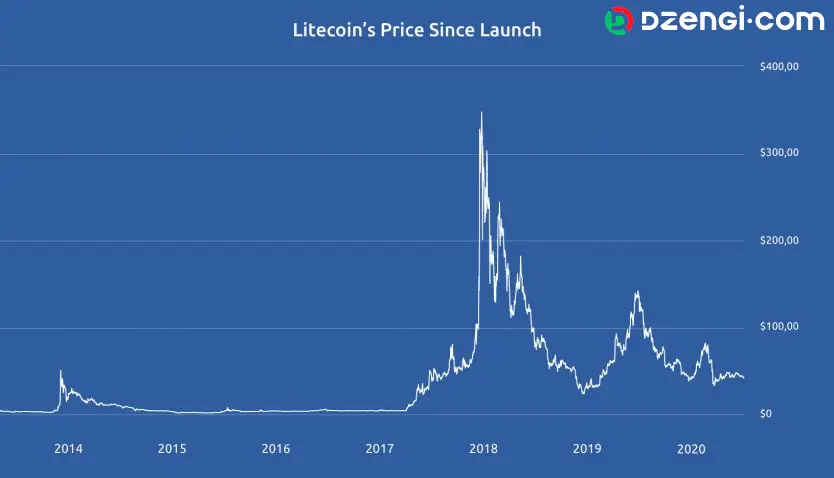

Litecoin is the world’s 17th-largest cryptocurrency in terms of market capitalisation – and the greater number of coins in circulation is reflected in its price, which is markedly lower than Bitcoin’s. Here’s how LTC has progressed since its launch in October 2011…

How to trade LTC: Its place in the market

When you learn how to trade Litecoin, it’s crucial to gain an appreciation for its place in the market, and understand the dynamics of the coin and what drives its price.

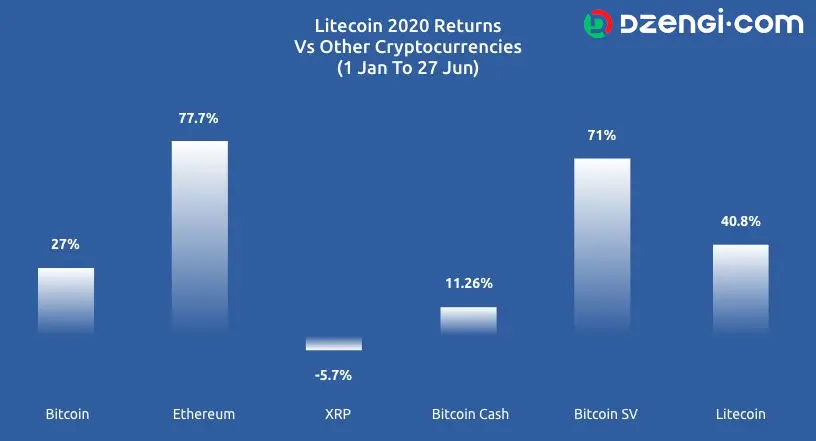

It’s interesting to note how the tables have turned this year, with Ethereum enjoying a runaway performance as LTC trades sideways. But what this metric doesn’t reflect is that Litecoin had managed to reach its all-time high in May 2021 at $390 before a couple of peak and valley corrections.

Next in our guide on how to trade Litecoin, let’s have a neat recap of the main factors that take its price up and down:

Where to trade Litecoin

Exchanges are often the best way to acquire LTC for the first time. Many of these trading platforms offer an “on ramp” that allows you to convert fiat currencies such as dollars and pounds into cryptocurrency. Some, like us here at Dzengi.com, also offer plenty of resources that can help you discover how to trade Litecoin successfully.

The best Litecoin trading strategies are backed by fundamental and technical analysis. This means that you’ll be guided by news coverage surrounding this altcoin and the crypto industry as a whole, as well as charts that enable you to detect trends in LTC’s price. You can also learn how to trade Litecoin by using a demo account that allows you to see how particular market moves would play out in a real-world environment.

Make sure you perform plenty of research into an exchange’s reputation, and scrutinise their security measures. Trading volumes can give you a crucial insight into a platform’s liquidity, and this will determine how easy it is to buy and sell LTC quickly.

Litecoin trading strategies: Some top tips

You can learn how to trade LTC by embracing some of the most common trading strategies for this cryptocurrency.

On Dzengi.com, you can assess how LTC/USD is performing in an interval of your choosing – from the market moves that have been made in the past minute, to a longer-term insight into its performance over the preceding seven days. Many Litecoin trading strategies are informed by candlestick charts. Bullish patterns can indicate that prices are about to rise, and traders will be also keen to detect bearish trends that suggest a sell-off may be on the horizon.

Many rookie traders who want to know how to trade Litecoin often fail to appreciate the importance of installing safeguards that protect their capital against sudden volatility. Without a stop-loss in place, investors wouldn’t have a safety net to catch them if prices plummet. Likewise, failing to dictate a take-profit order can be equally costly. This often-overlooked tool allows traders to decide in advance when they would want to sell their LTC, locking in earnings before the markets subside once again.

In the heat of the moment, it can be all too easy to make impulsive decisions when Litecoin trading. Unfortunately, these snap judgments seldom result in profitability, and commonly make losses worse. When you learn how to trade Litecoin, make sure you take the chance to take emotion out of the process.

Make sure you read a diverse range of opinion and analysis from the crypto community. This, when coupled with your own insights, gives you the best chance of accurately determining which way the wind is blowing. If you believe that LTC prices are going to decline, you’ll be entering into short positions and profit from the downturn. On the flipside, if you’re confident that there are brighter days ahead for Litecoin, going long can be the most lucrative outcome.