In this lesson you will learn:

- What leverage is

- What margin trading is

We’ve already given an overview of margin trading, to read that article click here. Let’s look at how margin trading works on Dzengi.com with Peter, who wants to invest €100.

About Dzengi.com and Peter’s €100

Peter knows that cryptocurrency margin trading can lead to quick returns. Peter decides to buy Bitcoin.

The price of Bitcoin at the time is €8,931. Peter believes that it will continue to rise and wants to buy 10 BTC immediately. But the total price of 10 BTC was €89,310 and Peter wants to start trading with €100.

Peter doesn’t have the money but still wants to buy Bitcoin. On Dzengi.com’s main trading screen, Peter searches for the pair Bitcoin/EUR. He clicks ‘buy’ and choses leveraged trading in the upper left-hand corner.

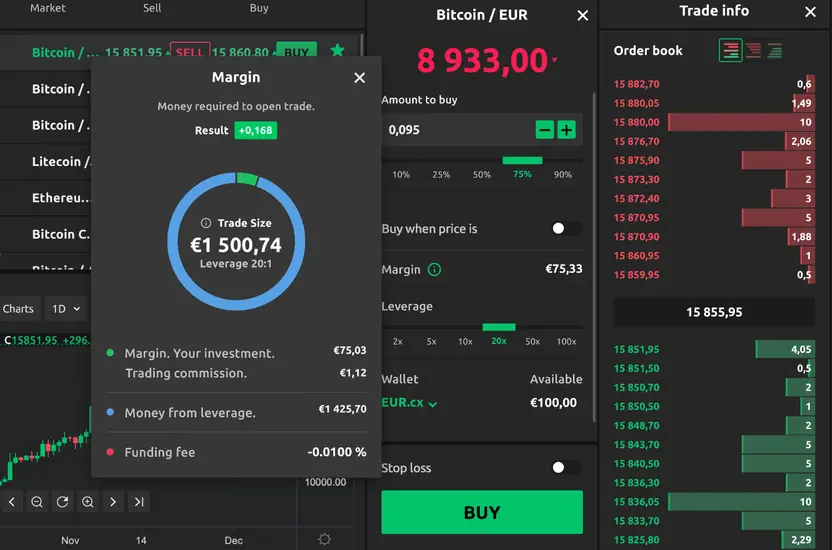

Leverage 20:1

With a sum of €100 in his account, Peter is offered 20:1 leverage – for every €20 he needs to invest €1 from his account. The remaining amount is covered by Dzengi.com. The deal (the full sum that is being paid for Bitcoin) is €1,500. The prepayment – the money he puts down for the deal – is €75.03. Peter receives around €1,425 from Dzengi.com. The platform trading fee is €1.12 and commission for the leverage is -0.0100 per cent. With this investment Peter can buy 0.167 BTC.

Let’s say that the price of Bitcoin rises to €10,000. If Peter sells his 0.167 BTC he’ll receive €1,670. If we subtract the amount loaned for the trade through leverage, €1,425, then Peter is left with €245. €75 of this figure is Peter’s money and the remaining €170 is profit from which fees will be deducted.

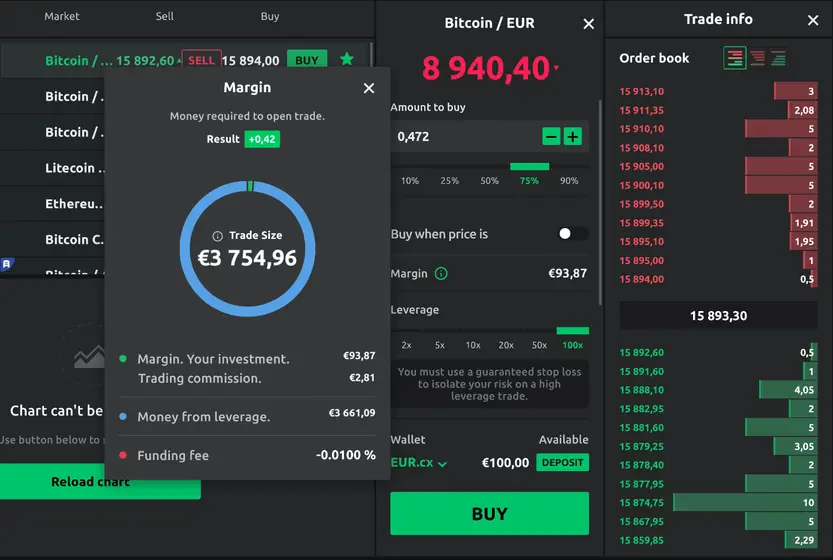

Leverage 50:1

If the leverage increases to 50:1 then the size of the deal also increases – up to €3,754.96, and Peter can buy 0.42 BTC. The prepayment will be €93.87, the trading fee €2.81, the leverage commission -0.0100 per cent and the size of the leverage itself €3,661. With this size of leverage, and the funds Peter is putting down, it is necessary to have a guaranteed stop-loss. This is a tool which doesn’t let you make a loss. If this tool is used a commission of 0.5 per cent is issued.

Let’s use the same example of if Bitcoin rises to €10,000. Selling his 0.42 BTC, Peter receives €4,200. €3661of this sum needs to be returned to the exchange. Peter is left with €539: he put €93.87 down at the start and then paid a trading fee of €2.81. Removing the leverage commission and stop-loss fee, this leaves him with around €440 in profit.

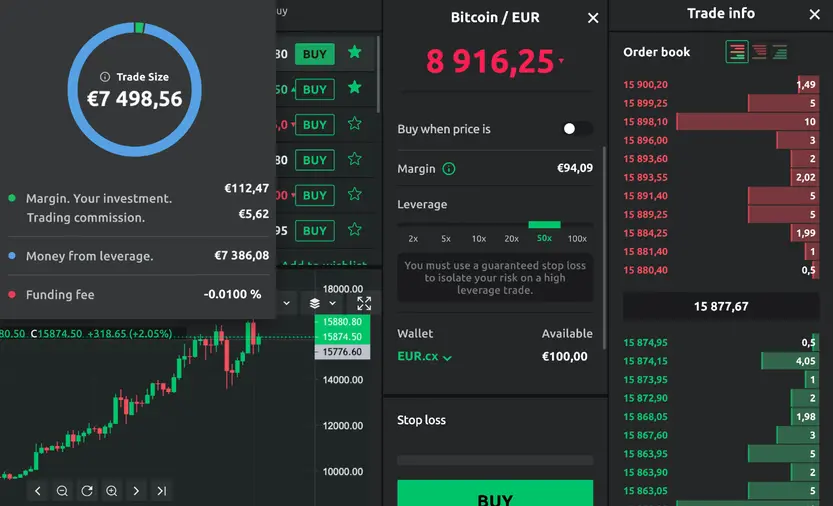

Leverage 100:1

A leverage of 100:1 requires more money from Peter than his €100 – a total of approximately €117.60 (€112 plus €5.60 in commission). Therefore this leverage isn’t available to Peter. Theoretically we can work out how much money Peter would have received if he had more money.

For €7,498.56 and Peter could buy 0.84 BTC. His prepayment would be €112.47, the trading fee €5.62, the leverage commission -0.0100 per cent and the leverage would be €7,386.08. The stop-loss commission, if a stop-loss order was used, would be 0.5 per cent.

With the value of Bitcoin at €10,000, Peter would receive €8,400 from selling his 0.84 BTC. From this he would return €7,498.56 to the exchange and pay about €6 in commission. After taking out his original stake of €112.47 he would be left with a profit of around €783.

What Peter needs to remember

1) Margin trading is inherently riskier than regular trading. This risk is even higher when it comes to cryptocurrencies. This strategy isn’t suitable for beginners, but if you still want to give it a try, then it’s better to start with a small stake. The ability to analyse graphs, identify trends and entry and exit points doesn’t eliminate the risks associated with margin trading, but it helps you to predict them better.

2) Margin trading on the exchange can increase both profits as well as losses. If the cost of Bitcoin falls, then Peter will lose money. Let’s say that the price of Bitcoin falls to €5,000. With a 20:1 leverage, Peter will receive €835 from selling his 0.167 BTC. Peter will need to pay back €1,425, as this is the leverage sum that needs to be returned to the exchange, and pay commission on top of this. After commission Peter’s losses will be more than €590.

3) A sudden change in the market can affect current transactions. Peter needs to keep an eye on the ratio of funds to prepayment:

If the level of prepayment exceeds 100 per cent then there is no need for additional funds because Peter has enough money to back up his open transactions.

If the level of prepayment falls to 80 per cent then Peter will receive a margin call.

If the level of prepayment is 50 per cent or lower, then the platform can close Peter’s transactions without warning until his margin account reaches 80 per cent of the funds again.

4) With only €100, Peter cannot buy 10 BTC – even with leverage. Cryptocurrency margin trading on Dzengi.com allows you to receive leverage up to 100:1. But with €100 in his account and the price of Bitcoin at €8931, a leverage of 100:1 still wouldn’t be enough to buy even one Bitcoin. Peter’s stake needs to be more than €1,000.

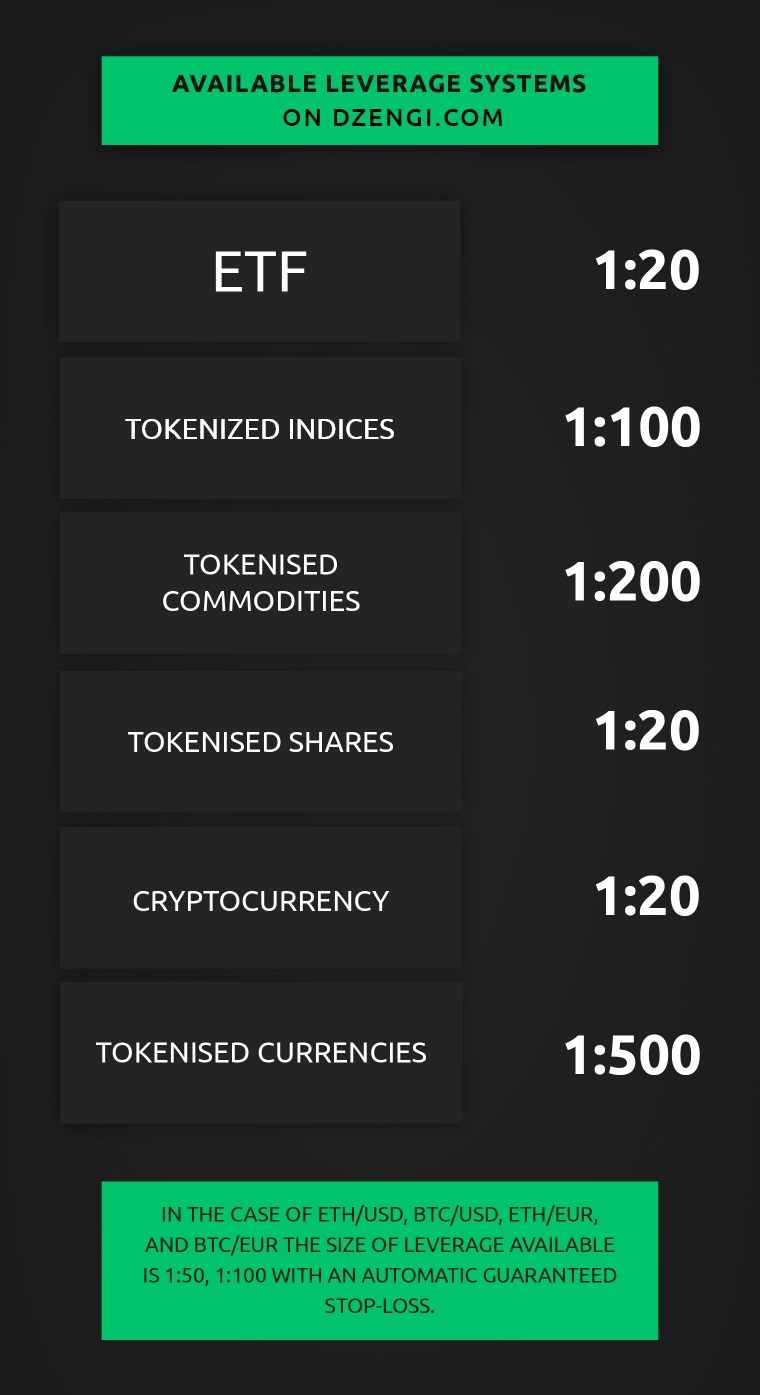

5) The amount of leverage commission on Dzengi.com depends on the group of the tokenised asset

6) Leverage commission applies to leverage orders held overnight in accordance with the market rate and is also applied on days when the markets are closed. These fees are always clearly shown. Additionally, leverage commission is charged every eight hours for ETH/USD, BTC/USD, ETH/EUR and BTC/EUR and every 24 hours for tokenised assets.

7) A guaranteed stop-loss order allows you to avoid unexpected losses with volatile price changes. It stops the transaction occurring at any price other than the one specified.

If Peter installed a guaranteed stop-loss order and this condition was met, then this commission is deducted from his account. The size of this fee depends on the asset, and it is clearly shown in the order edit window. The commission for trading with leverage is shown in the final result of the trade.

8) The sum of the prepayment for the ‘guaranteed stop loss’ is calculated as follows:

The sum of the prepayment = trade volume ÷ size of the leverage + trade volume × GSL commission

Trade volume = the quantity of the asset × the price when order is placed

9) In the case of ETH/USD, BTC/USD, ETH/EUR and BTC/EUR with a leverage of 1:50 or 1:100 the guaranteed stop-loss is set automatically and is calculated using the formula:

The sum of the prepayment = (price when order is placed - price level) × quantity of the asset + (price when order is placed × GSL commission × quantity of the asset)

10) P&L – profit or loss on pending transactions in the section ‘leverage trading’ (margin trading on the exchange), is calculated as follows:

P&L = the quantity × (current price = price during transaction)

P&L of the wallet is equal to the sum of profit or loss of all current trades in this wallet

11) If Peter buys tokenised bonds with leverage then he will receive full dividends on them.Dividends on tokenised assets are paid when they are purchased both with and without leverage.

12) Let’s say that Peter doesn’t know what cryptocurrency margin trading is. If Peter didn’t use leverage on Dzengi.com and instead traded only with his €100 then he could buy 0.01119695 BTC. Peter’s profits if the value were to reach €10,000 would only amount to €11.

13) The difference between margin and ordinary trading for Peter. Margin trading: the ‘creditor’ won’t allow Peter to withdraw assets he bought with the help of the exchange’s money or do whatever he wants with them. Ordinary trading: he owns all his money.

14) When trading with leverage on Dzengi.com Peter can use the wallets: USD.cy, EUR.cy, GBP.cy, BYN.cy, RUB.cy, BTC and ETH. In order to understand the terminology that Peter needs to deal with, we have prepared a short memo:

- Funds: this is the balance of all completed transactions and also the sum of the equity excluding the P&L for incomplete transactions in the Trading with leverage section

- P&L: this is the profits or losses made on any pending transactions in the Trading with leverage section

- Equity = funds + P&L. This shows the amount of funds deposited, (un)realised profits or losses minus commission and withdrawals

- Reserved: this is the sum of the funds taken as prepayment for any transactions in the Trading with leverage scheme, as well as for limit orders in the trading scheme

- Available = equity - reserved. This sum of funds is available for withdrawal at the current moment

- Equity = available + reserved = funds + P&L

15) Cryptocurrency margin trading – this is a type of speculative operation with cryptocurrency on the crypto exchange. Margin trading stocks can differ only in the size of leverage available. The popular rating service Coinmarketcap currently tracks millions of cryptocurrencies (the vast majority of which are non-competitive) and hundreds of crypto exchanges. At one time, not even all major platforms offered leveraged trading, but today it is impossible to compete in the crypto trading industry without this service.

If you have any questions about this topic, please contact Dzengi.com support.