In this lesson you will learn:

Nine essential solutions for starting to trade cryptocurrencies and tokenized assets

So, bitcoin trading: what it is, how to start, and what to pay attention to – we suggest studying 9 simple solutions.

Don't confuse them with professional investment advice; rather, take these solutions as theses to think about. If you need investment advice, consult with professionals.

Our task is to show beginning traders and crypto investors how to start trading bitcoin, and that the first steps can be clear and simple.

Solution #1. Learn Everything About Bitcoin

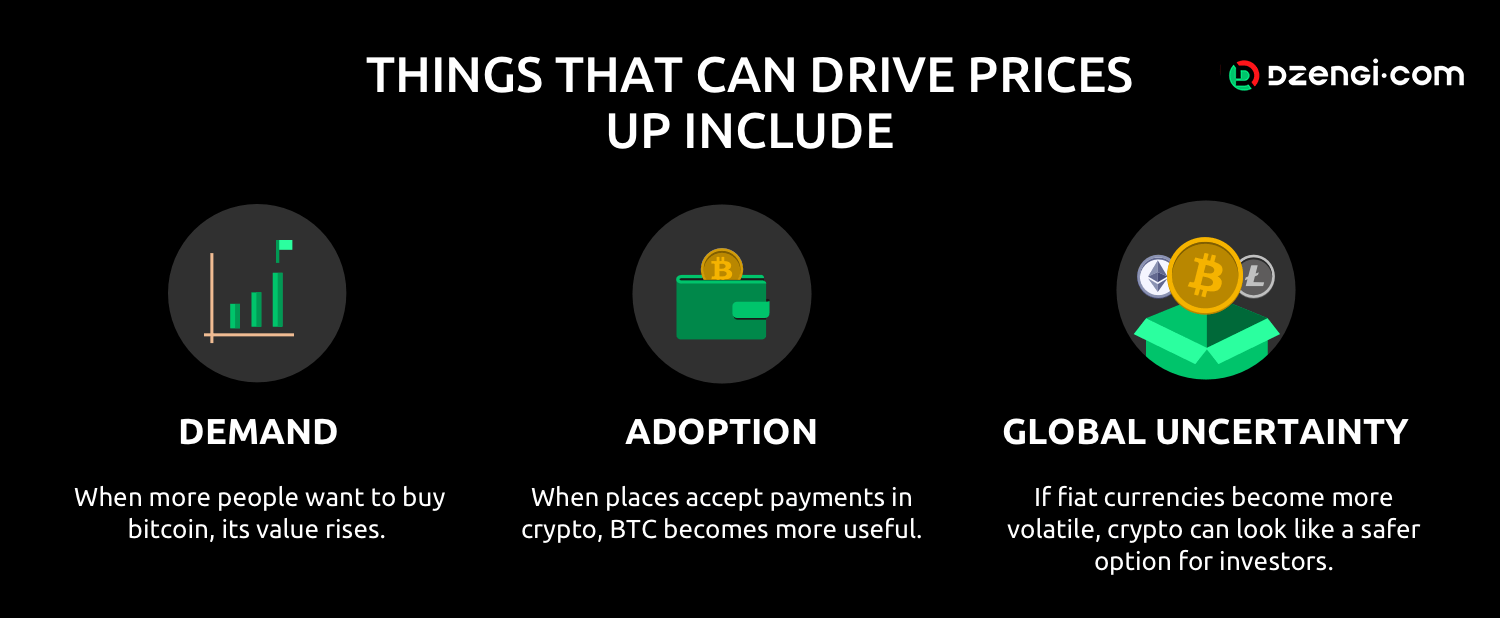

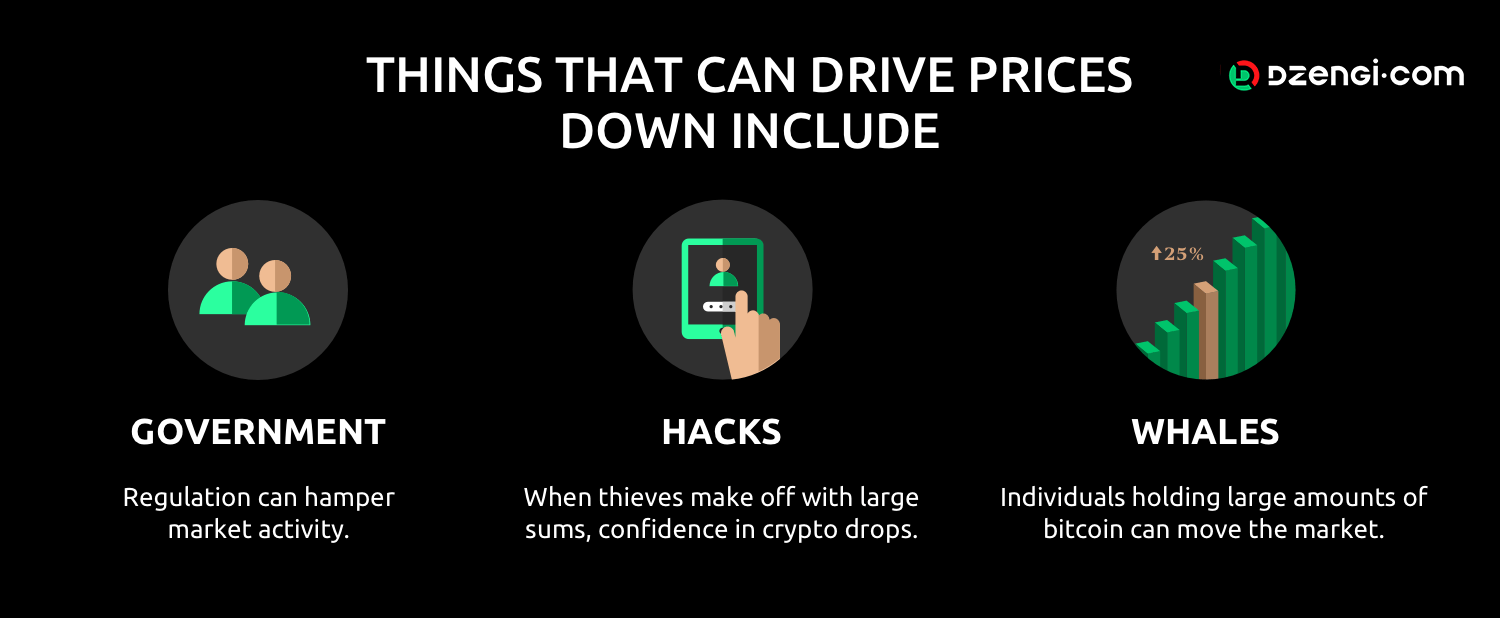

Study what you're investing in. It's easy to fall into euphoria, believing that the price of bitcoin can reach a million dollars per coin, or conversely, drop to a thousand. Analyze forecasts and what they're based on. Read more, monitor the market until you get the feeling that you're beginning to sense it. Then BTC trading will bring what you expect.

Bitcoin is still not legal tender, except in a few countries. Governments and banks don't like bitcoin as much as its owners do. For now, digital currency is an additional asset class.

Bitcoin issuance is limited to 21 million coins. The ability to trade a fraction of bitcoin allows these 21 million to be divided 100 million times—theoretically. It works like this: on an exchange, we most often specify the amount we want to invest. The exchange calculates how many coins or what portion of bitcoin we can buy for this amount.

Solution #2. Trade on an Exchange Yourself, Not Through a Broker

How to trade bitcoin on a crypto exchange? This can be done yourself or through a broker. Usually, people turn to intermediaries who don't have the time or experience (knowledge) to trade themselves. Commissions for various broker services can total up to 15% of income. The income tax will cost the same or more (depending on the country).

If you're faced with the choice of starting to trade bitcoin on an exchange yourself or through an intermediary, try it yourself. It's not that complicated. Plus, you'll save on broker commissions. And knowledge and experience are acquired over time.

Solution #3. Choose a Reliable Crypto Exchange

So, you've decided that your bitcoin trading will be on an exchange without intermediaries. Now all you need is to choose a reliable crypto exchange. You can look at top lists by queries, for example:

- Best regulated cryptocurrency exchanges (Europe, USA, Asia, etc.)

- Best regulated platforms for buying bitcoin

- Cryptocurrency exchanges with low deposits

- Crypto exchanges with margin trading

- Best cryptocurrency exchanges user reviews

- Top cryptocurrency exchanges by trading volume, etc.

Everything depends on what you want to get or how you plan to trade. If the goal is a one-time bitcoin trade (buying, selling) or an altcoin, then crypto exchangers may be simpler and faster, but commissions there may be higher than on exchanges.

If you want to trade regularly, reliable cryptocurrency exchanges are more suitable. Choose jurisdictions where BTC trading is regulated.

Dzengi.com

A reliable cryptocurrency exchange is, first and foremost, a regulated cryptocurrency exchange. Read here about how to choose one.

Solution #4. Develop a Trading Strategy

You've already decided that trading bitcoin on an exchange is your option. Are you going to make short-term trades or do you want to choose long-term investing? Or maybe you're interested in medium-term?

Strategy is something you need to think about. But whatever cryptocurrency trading strategies you choose, each will require rational, well-considered decisions and discipline.

Long-term (long-term investing) doesn't give lightning-fast results, can be stretched over years and become a way of life. "Why trade when you can hodl," say those who invested in bitcoin many years ago when the rate was laughable by today's standards. As practice shows, they all benefit from Buy&Hold and bitcoin's wild volatility. The main thing is to keep bitcoins in a cold wallet.

Among the drawbacks of long-term—you can't acquire trading skills, something that can become a good source of income. Plus, everyone has their own risk tolerance, and adrenaline is part of a trader's lifestyle.

Dzengi.com

Short-term (short-term investments) is built on quick earnings from rate changes during the day. Among the drawbacks of short-term—commissions for trading and used instruments are charged with each transaction, and they differ for each exchange. Here it's important that trading income be greater than the commission. Otherwise, there's no point in trading—unless just for experience.

Medium-term (medium-term investments) usually starts from a trading time interval from one or two weeks to a month.

Bitcoin trading in the medium term on Dzengi.com is considered one of the successful strategies for beginners. There's time to think through your decisions well and get profits fairly quickly.

Dzengi.com

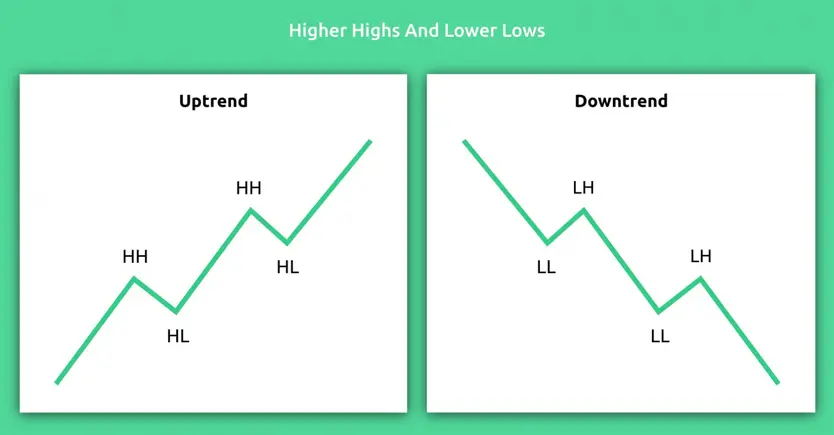

The very volatile cryptocurrency market often changes its "mood." It needs to be watched. Bitcoin trading and trading in general will require certain efforts on your part. Perhaps you'll want to choose a different strategy to earn more and adapt to the current market when it shows a strong bearish trend and trades in a narrow range. If you're not careful, without trading experience there's a big risk of incurring losses.

Solution #5. Use Exchange Tools

It would be good to ask yourself how to trade bitcoin before you start trading.

All transactions on an exchange, including bitcoin trading, are executed through orders. An order is a buy/sell request. Orders come in different types. Among the main and common ones are market orders, limit orders, and stop-losses.

For example, you bought a portion of bitcoin for $500 at a market price of $6,600 per coin. This will be a market order—a regular buy/sell at current prices.

Now you want to make a quick profit and sell your portion of bitcoin when the price rises. Or buy more when the price falls. You place a limit order to sell at $7,000 and to buy at $5,000. In a limit order, you can set a price limit—buy below or sell above the current market price, and this will always be a transaction at a price better than at the time the order was placed.

Let's say you want to sell bitcoin because the price is falling. You bought a portion for $500 when it cost $6,600 per coin, and you wouldn't want to lose much. The price could drop, for example, to $3,000 per bitcoin—then you would lose more than half of your investment. Therefore, you set a stop-loss at $6,500 to sell your portion if the price starts to fall. In this case, you won't lose as much.

A stop-loss allows you to set a price limit, but this will be a transaction at a price worse than at the time the order was placed.

A crypto exchange is access to the global market 24/7. The market never sleeps. Automating your strategy using limit orders, stop-losses, or other tools is a good solution.

Dzengi.com

On some exchanges, using limit orders incurs lower commissions than market orders. There are also platforms with free limit orders. If your chosen crypto exchange rewards the use of certain types of orders, try to use them.

Margin trading of bitcoin is also an interesting tool that multiplies both profits and losses. It may also be called leverage or trading bitcoin with leverage. You take a sort of loan from the exchange, pay a commission for it, and return it after some time. Read more about margin trading in our article.

Solution #6. Study the Risks

We've written many times about what risks exist and how they can be avoided. Let's briefly repeat:

- Be careful and beware of fraud, ignore sites that promise you quick and easy money if only you give them X, Y, and Z.

- Don't download random wallets and don't click on random links to avoid installing malware on your devices. Beware of spoofing. Double-check that you're using the correct link. Some fraudulent sites may use a similar domain for phishing scams. Always verify such things.

- Choose regulated exchanges. The cryptocurrency market and bitcoin trading are like the Wild West without a sheriff. According to statistics, victims of hacker attacks are mainly unregulated platforms.

- Don't pay attention to market noise, conduct your own market research. Trading cryptocurrencies on the advice of other people who are not professionals is not the best investment method. Even professionals make mistakes. Only you are responsible for your own trades and investments!

- Don't share your private keys or passwords with anyone. If you can avoid connecting to the network when entering your private keys and passwords — take advantage of this.

Solution #7. Don't Invest More Than You're Ready to Lose

Don't invest more than you can afford to lose. Betting that you'll never have to work again if you put all your savings into bitcoin is like playing the lottery.

At the moment, bitcoin is both king and queen. But it may not always be this way, and it's quite possible that BTC could eventually be displaced by another altcoin. Yahoo was also once a search giant. Now it's Google.

Solution #8. Start with Small Investments

According to statistics, the larger the size of your investment, the greater the potential risk/reward for the position. Reward is good, but to get it, it's important to limit risks in the short term. The reality is that the risk with large bet sizes (relative to your investment portfolio) outweighs the potential benefits.

Let's say you invested $100 and want to turn it into $225. If you turn it into $25, then returning to $100 becomes difficult. Not to mention getting $225 from the remaining $25:

- $100 is a 300% increase from $25

- $225 is a 900% increase from $25

With your investment, you can afford to lose 5%:

- if you risk 5% of $100, you're risking $5

- returning to $100 from $95 will require an increase of approximately 5.264%

Of course, through such small bets it will take more time to get $225, but you'll have more opportunities to make a profit and avoid losses. Plus, you'll gain skills that will help you rely less on luck alone.

Solution #9. Diversify Your Investment Portfolio

If you bet only on bitcoin (or only on one altcoin), then in case of failure you can lose everything. Let's say you use different strategies, which to some extent protects you from this. But this isn't certain, because if you're a beginner and just starting to try yourself in trading, you won't have enough experience to quickly react to market "moods."

There's nothing more annoying than being disappointed in bitcoin, switching to ethereum or other alts, missing bitcoin's price jump during this time, returning to it and missing ethereum's price jump. If you invest in several coins at once, you won't miss their giant price jumps in a short time.

Although this isn't the most profitable tactic, diversification helps investors survive turbulence in the markets.