Bitfinex’s LEO was deployed after a series of controversies for the crypto exchange

Contents

- Leaks, hacks and controversies

- Utility of the LEO token

- Buy-backs and burns

- Key LEO coin figures

- Origins of the name

- FAQs

UNUS SED LEO, launched through an initial exchange offering (IEO) in May 2019, is the latest cryptocurrency project of the Bitfinex cryptocurrency exchange’s parent company, iFinex. The token launched after the US government’s seizure of funds held by Crypto Capital, Bitfinex’s former payment processor.

Leo, not the first digital currency to be launched throughout iFinex’s turbulent history, is a dual-chain utility token living on the Ethereum and EOS blockchains. Among the numerous unique aspects of the project, LEO is one of the few cryptocurrencies with a limited lifecycle built into its protocols.

We dive into all the main elements of LEO in the following guide. What is UNUS SED LEO (LEO)? Keep reading to find out.

Leaks, hacks and controversies

To get a true sense of the LEO coin project, it is important to understand the history of Bitfinex and Tether. Despite both entities making claims to the contrary, the “Paradise Papers” leak revealed that Bitfinex and Tether were controlled by the same parent company, the British Virgin Island-based iFinex. Further controversy ensued when Bitfinex and Tether were accused of moving hundreds of millions of dollars between each other to cover up Tether’s insufficient fiat reserves.

In February 2021, the New York State attorney general’s office said: “Bitfinex and Tether deceived clients and market by overstating reserves, hiding approximately $850m in losses around the globe.” Penalties of $18.5m were issued and, as of today, Bitfinex is banned from operating in New York state. Both companies are also required to submit quarterly reports to ensure compliance with these prohibitions and proper business segregation.

It is not the only public relations nightmare in Bitfinex’s lifespan. The exchange effectively shut down in 2016 after a hack which led to almost 120,000 bitcoin (BTC) being stolen from the exchange. The blacklisted funds, worth $67.47m at the time, are now worth more than $5.1bn.

After the hack, Bitfinex was forced to allocate these losses across all Bitfinex account holders, crediting customers with the specially designed BFX token at a ratio of one BFX to $1. The practice of creating tokens out of thin air to prop up financial losses may seem dubious to some; however, to the exchange’s credit, all BFX tokens were redeemed within eight months. In collaboration with the US government, the recovery of stolen BTC continues to this day. In December 2021, 6.5 BTC were recovered.

—

The exchange also copped a fine from the US Commodity Future Trading Commission (CFTC) in 2016 for failing to register as a futures commission merchant, prompting a reassessment of its business practices. The commission said: “CFTC recognises Bitfinex’s co-operation with the Division of Enforcement’s investigation, and that Bitfinex voluntarily made a number of changes to its business practices in order to attempt to come into compliance with the CEA (Commodity Exchange Act).”

Utility of the LEO token

So what is UNUS SED LEO (LEO) coin used for? It was primarily created to bring benefits to users of the iFinex ecosystem (perhaps as a way of regaining trust following the issues discussed above). LEO gives all holders a range of discounts on the Bitfinex trading platform and other iFinex products. Discounts include taker fee reductions, lending fee reductions and withdrawal and deposit discounts.

There is little else in terms of token utility apart from these holder discounts. Unlike FTX and other tokens launched by exchanges, LEO cannot be used to create leveraged positions.

Buy-backs and burns

One of the unique features of LEO coin is its intentionally limited lifespan. How does UNUS SED LEO work to achieve this? IFinex commits 27% of gross revenues to a buy-back scheme at prevailing market rates, until no tokens remain in commercial circulation. Since iFinex owns Tether, it should be assumed that this 27% figure includes revenues raised through Tether; Dzengi.com has requested confirmation of this.

The white paper states that 80% of any BTC recovered from the 2016 hack will also go towards the buy-back scheme. So far, 6.5 BTC have been recovered. Additionally, should iFinex ever recover funds lost from the US government’s seizure of the former payment processor Crypto Capital, 95% of recovered funds is pledged to the buy-back scheme.

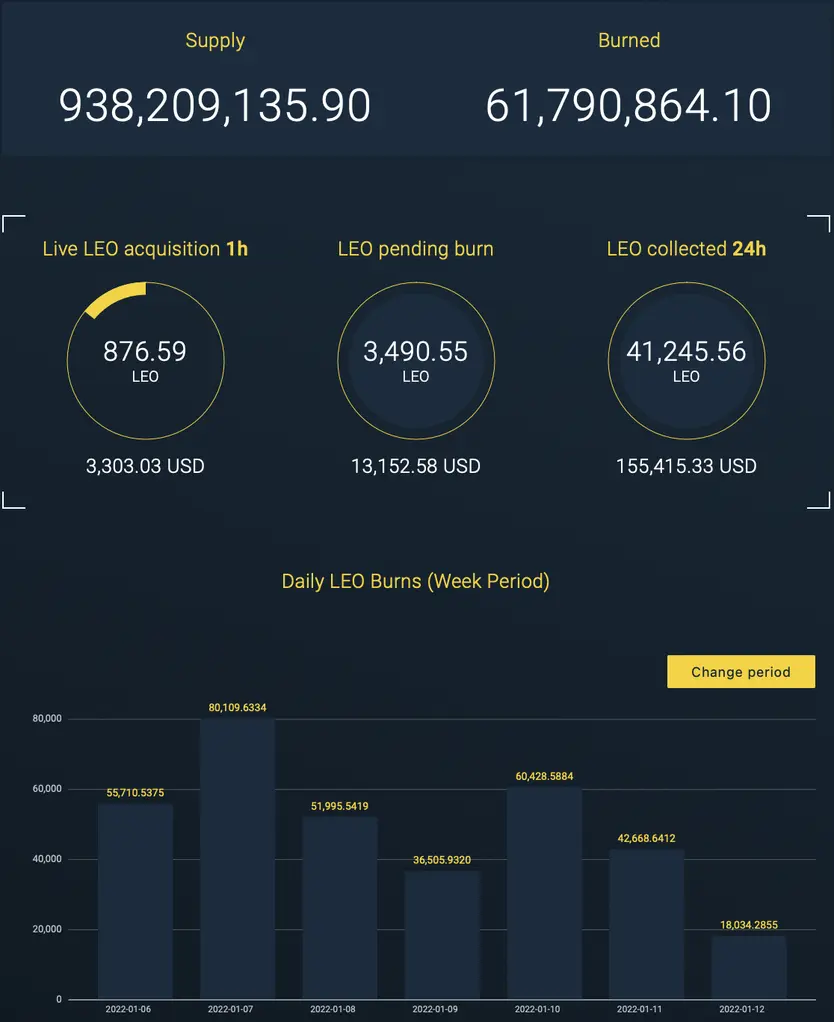

At the time of writing, a total of 61,790,865 LEO from the one billion supply has been burned, equating to over $232m.

The total lifespan of the UNUS SED LEO cryptocurrency is contingent on the amount of fees generated through iFinex.

Key LEO coin figures

The UNUS SED LEO cryptocurrency, priced at $1 per token, underwent an initial exchange offering (IEO) in May 2019, naturally on the Bitfinex exchange. US customers were excluded from the IEO. In a unique two-chain IEO, 64% of the one billion total supply was issued on the Ethereum blockchain and 36% on the EOS blockchain. Bitfinex allows for interoperability between the two chains.

The white paper stated that proceeds of the IEO “may be used for working capital and general business purposes, including capital expenditures, operating expenses, repayment of indebtedness and other recapitalisation activities”.

The trading value at time of writing was $3.78 with a circulating supply of 938.2 million. Market capitalisation currently stands at more than $3.6bn, making LEO a top-50 cryptocurrency with a market ranking of 44.

Despite being the native utility token of the Bitfinex exchange, the LEO/USD pair has a poor liquidity rating of 375, according to Coin Market Cap’s analysis. Other popular exchanges include FTX and gate.io.

Origins of the name

The name is taken from the Latin phrase “Unus Sed Leo”, pulled from the Greek storyteller Aesop’s fable The Sow and the Lioness. Translated as “one, but a lion”, the phrase encapsulates the fable’s moral, which centres on the philosophy of quality over quantity, in that the might and bravery of a single lion cub is greater than an entire sow’s litter.

Hubris aside, Bitfinex has endured its fair share of trials and tribulations over the course of its existence, yet it still remains a major player in the cryptocurrency exchange market, with more than one million weekly visits and 173 tradable assets.

FAQs

From an initial supply of one billion, there are currently slightly more than 938.2 million LEO coins in circulation. This number steadily decreases through LEO’s buy-back scheme.

The UNUS SED LEO project was launched by iFinex, the parent company of the Bitfinex cryptocurrency exchange and Tether stable coin.

UNUS SED LEO (LEO) has a finite life cycle. Parent company iFinex’s buy-back and burn scheme contributes 27% of company earnings to the scheme, which will conclude once the last LEO token is burned.