FTX’s positive approach to regulation, strong liquidity ratings and major endorsements imbue confidence

Contents

- FTX Token (FTT) key details

- How is FTX.US different?

- Publicity drive

- Key FTX statistics

- What are the fees on FTX?

- FAQs

FTX is a centralised cryptocurrency exchange launched in May 2019 by a seasoned team of traders and software engineers. Since then, FTX has gained a significant market reputation, driven by robust regulatory compliance and strong liquidity ratings.

The native FTT cryptocurrency is an ERC-20 standard token, ranked in the top 40 by market capitalisation.

FTX bills itself as a trader-focused exchange, “built by traders, for traders.” As well as standard exchanges of large and mid-cap cryptocurrency pairs, FTX also allows for initial exchange offerings (IEOs) to be conducted, most recently for the in-development metaverse project Star Atlas.

With big-ticket celebrity endorsements and multibillion-dollar daily trading volumes, FTX has cemented itself as a major player in the competitive crypto exchange market. So what is FTX Token (FTT) and how does the FTX token work? Read on to find out.

FTX Token (FTT) key details

The FTT coin is an ERC-20 standard token which was released in July 2019. The maximum supply is capped at 350 million, with 138.76 million currently in circulation at $36.28, for a market capitalisation of $5.03bn. The FTT coin is listed at number 34 on the cryptocurrency market cap charts.

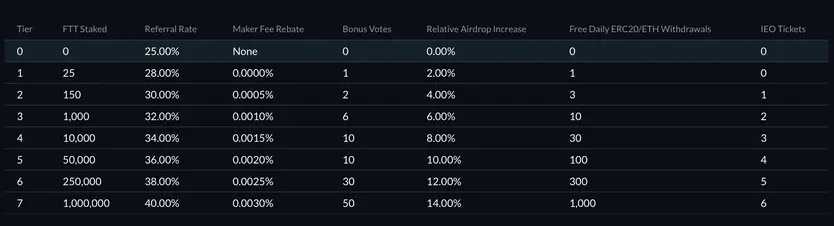

So what is FTX Token coin used for? FTT can be used to create leveraged tokens on the FTX exchange. Keep in mind that while levereged positions can significantly multiply your losses as well as your gains. FTT can also be staked, with a tiered rewards structure which can be seen below.

FTX has a burn programme, in which 33% of fees generated on the FTX exchange go towards purchasing and subsequently burning tokens.

In addition to the FTX exchange, FTT is available on Binance, Bitfinex, Huobi Global and AscendEX. However, FTT is not available on FTX.US.

An Etherscan search shows that company tokens account for just shy of 52% of maximum supply, while 105 million FTT tokens are set aside for marketing, backstop liquidity and other insurance purposes.

How is FTX.US different?

Because of conflicting regulatory policies surrounding cryptocurrencies in the United States, FTX’s international platform is not available to US traders. This prompted FTX to establish a jurisdiction-specific platform with FTX.US.

FXT.US has limited features. Only 24 cryptocurrencies are available, against FTX’s 302, although these are the main assets that major traders are largely concerned with, including Bitcoin, Ethereum and even Dogecoin.

FTX.US is headquartered in California and is compliant with federal and state regulation, including anti-money laundering and derivatives legislation. Citizens of New York state are out of luck; FTX.US is unavailable in that jurisdiction.

As per FTX’s pro-regulation approach, the exchange outlined various proposals for US regulatory cohesiveness in a blog post. Most notably, a unified market regulator and rule book for both spot and derivatives listings was suggested.

The blog stated: “Getting crypto market regulation appropriately calibrated is critical for the continued development of a healthy, transparent, and well-functioning global crypto markets, which we believe will deliver knock-on positive effects to the global economy as a whole.”

A more unified approach to the US’s fragmented regulatory policy would reduce operational complexity, according to the post.

One benefit of FTX.US is its NFT trading platform, which is unavailable on the international platform.

Publicity drive

Despite having limited penetration in the US cryptocurrency exchange scene, FTX recently cemented numerous large-scale sponsorship deals and partnerships. CNBC reported that the American football legend Tom Brady and his Brazilian supermodel wife Gisele Bündchen recently took a stake in FTX, while an FTX.US patch can now be seen on all major-league baseball umpire uniforms.

—

FTX is not the only major exchange to pursue major sporting sponsorships. In November 2021, Crypto.com purchased the naming rights for the NBA team LA Lakers’ home arena for a purported $700m price tag. The arena had been named the Staples Center since 1999.

Key FTX statistics

In terms of trading volume on the exchange, CoinMarketCap reported a 24-hour trading volume on 7 January of $3.05bn. To put that into context, Binance reported $22.05bn and Coinbase reported $5.78bn in trading volume. This does not include FTX.US, which reported an additional $279.89m in trading volume.

More than 5.1 million visits to the exchange in a week were counted, while 302 cryptocurrency assets are currency listed on the exchange. While other exchanges, including KuCoin and Gate.io, boast a far greater diversity of tradable assets, a lack of token due diligence on these platforms opens the floodgates to scam coins, rug pulls and other poor-quality assets.

Major fiat currencies accepted on the exchange include USD, EUR, GBP, AUD, HKD, SGD, CAD and numerous others.

Tracking the order book depth of the top 25 trading pairs on FTX presents a liquidity score of 715/1000, slightly above Coinbase’s score but below Binance’s 813. Regardless, a score of 715 suggests that the primary trading pairs on FTX are highly liquid, reducing the potential for slippage.

Combining these factors, CoinMarketCap places FTX as the third most trusted exchange, before Binance and Coinbase.

What are the fees on FTX?

FTX has a six tier fee structure contingent on the volume traded over a 30-day period. For total trades below $2m, maker fees are set at 0.02% of volume traded, while taker fees are set at 0.07%. These fees reduce in 0.05% increments at the $5m and $10m marks. Total trades over $25m per month do not incur any fees.

A quick note on makers versus takers: A maker is a buyer or seller contributing to liquidity, whereas a taker is a buyer or seller subtracting from liquidity. If a buyer places an order, they are contributing to liquidity. Likewise, if a seller places an offer to sell, they are also contributing to liquidity. The respondent to either offer is the taker. Since liquidity benefits an exchange, maker fees are typically lower.

Holders of the FTX Token (FTT) also benefit from fee discounts, which you can see in the table below.

FTX also provides a VIP programme for professional traders, while FTT stakers also benefit from maker rebates.

FAQs

There are currently 138.76 million FTT in circulation, against a maximum supply of 350 million.

FTX Token (FTT) was co-founded by chief executive officer Sam Bankman-Fried, previously a trader at Jane Street Capital, and chief technology officer Gary Wang, previously a software engineer at Google. FTX is also backed by major venture capital and private equity firms including Sequoia and Ribbit Capital.

CoinMarketCap ranks FTX in the top three most-trusted centralised exchanges. Strict KYC details are required for access to the trading platform. Sister exchange FTX.US is compliant with all necessary US federal and state legislation.