Forecasts have been boosted by rising volumes and the growth of Binance Smart Chain

Contents

- Is BNB a good investment in 2022?

- What are the factors behind upbeat Binance Coin predictions?

- New records ahead?

- FAQs

Binance Coin (BNB) has come a long way since its humble launch in the summer of 2017. The coin was developed and designed specifically for use in the Binance ecosystem, offering rebates to incentivise its use. All coins were pre-mined before their initial coin offering (ICO), with a price set at $0.10 per BNB.

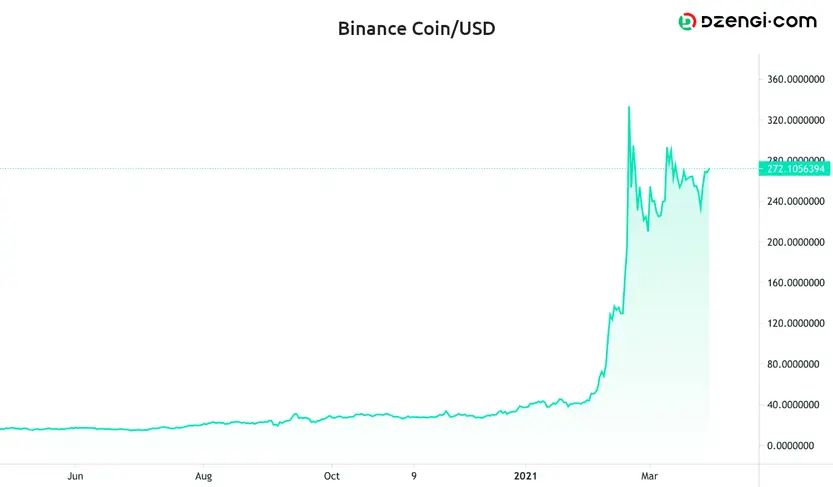

Despite the crypto winter of 2018, BNB has proven resilient in the altcoin markets – and fast forward to the start of a new year in 2022, Binance Coin’s price still carries a lot of interest. The coin gained roughly 1,344% in 2021, according to Arcane Research, compared with a 73% increase for Bitcoin, and 455% for Ethereum.

BNB demand has grown following a dramatic acceleration in the cryptocurrency’s price. Over the course of 2021, Binance Coin rallied from around $38 in January to an all-time high of $683.82 in early May, and also saw another a high of $668.07 in early November. At the time of writing on 30 December, the price was trading at roughly $523.05.

But what is BNB? And does a Binance Coin price prediction suggest we will see this major altcoin break new records again in 2022?

Here, we are going to look at the fundamentals behind BNB’s price, and the factors that influence this cryptocurrency the most.

Is BNB a good investment in 2022?

To answer this, let’s have a quick recap of what Binance Coin is actually for.

Launched by the major crypto exchange of the same name, BNB is designed to serve as the lynchpin of the Binance ecosystem. One of the main attractions lies in how this altcoin can be used to unlock discounted trading fees. BNB also has a starring role in the Binance Smart Chain, which is vying to become a rival to Ethereum that offers greater levels of scalability, along with lower transaction fees.

One of the most vocal supporters of BNB – with a Twitter following of more than 4.7 million – is Binance CEO Changpeng Zhao, commonly known as CZ. In a recent tweet, he said:

“#BSC (of which I am just a community member), is not replacing ETH, but it is overtaking ETH. Lower fees enable more transactions, which leads to a more inclusive #DeFi ecosystem.”

Although CZ stresses that he does not give financial advice, his enthusiasm for Binance Coin, the BNB price prediction for 2022 and this cryptocurrency’s potential are clear. He has retweeted posts that describe this altcoin as far superior to ETH – the world’s second-largest cryptocurrency.

Currently, this digital asset has a market cap of about $87.1bn, meaning that it has also started to gain ground on ether, which has a total valuation of $446.4bn. Although talk of a ‘flippening’ may seem rather far-fetched, BNB proponents are adamant that this digital asset has the potential to gain more ground in the future.

CZ has also shared posts that suggest BNB coin price predictions have been wrong over the years, encouraging users and the wider public domain to be cautious when making investments, and reminding them that information provided on the forum is not financial advice.

In one tweet, he explained how many people were reluctant to invest in 2017 because it was too risky, while it wasn’t worth investing in 2018 because the market had crashed. Although there was interest in 2019 and 2020 to see whether Binance Coin would gain momentum, one narrative put forward in 2021 was that BNB has already pumped – meaning it is too late to enjoy further price movements.

That same tweet argued that we are still at an early stage in the crypto market’s evolution, adding:

“A $500 investment in $BNB back in mid-2017 would have made you a millionaire today.”

It should be noted that in June 2021, UK financial regulator, the Financial Conduct Authority (FCA), issued a warning about Binance Markets Limited (BML) and the Binance Group, ruling that BML “is not permitted to undertake any regulated activity in the UK” as it lacks the relevant authorisation.

The watchdog also advised people to be “wary of adverts on social media promising high returns on investment in cryptoassets”.

In response, Binance – the world’s biggest cryptocurrency exchange – said that “BML is a separate legal entity” and the FCA notice would have no “direct impact on the services it provides from Binance.com”.

The Binance Group acquired BML in May 2020 and has not yet launched its UK business – nor has it been able to permitted to undertake any regulatory activity, as per the FCA notice.

Naturally, how the FCA and other institutions handle regulation will determine the fate of the coin, or at least investors’ access to funds, as new rules are rolled out by local legislators. But of course, do remember that the markets can be very unpredictable, and what has happened in the past isn’t always an accurate prediction of the future.

What are the factors behind upbeat Binance Coin predictions?

A BNB price prediction tends to be the most bullish when there is a flurry of trading activity on the platform. Binance has repeatedly seen volumes break new ground as traders attempt to capitalise on the new highs seen in bitcoin, ether and other cryptocurrencies. With BNB opening the door to reduced fees, demand for the 166.8 million coins in circulation will undoubtedly rise when crypto enthusiasts are vying to log on to their accounts in a hurry.

As we mentioned earlier, the increasing role of Binance Smart Chain is also significant. Several decentralised finance (DeFi) projects have already made the leap – shifting their protocols from Ethereum as they seek to ensure that transactions are affordable and fast for users. With the ETH 2.0 upgrade expected to be more than a year away, demand for this blockchain could be set to rise further. Work to address centralisation concerns is also under way.

A Binance Coin price prediction is helped further by the fact that the exchange behind BNB regularly enters into high-profile partnerships and collaborations with other crypto projects – and in other cases, offers a Launchpad service that enables new ideas to reach the market far faster than they may have done otherwise.

Such agreements typically result in BNB being accepted by a greater number of merchants, meaning there is much greater scope for the cryptocurrency to be used for purchases.

New records ahead?

According to a Binance Coin price prediction 2022 from Long Forecast, BNB could be on track to hit $891 by the end of the year.

A BNB coin price prediction from DigitalCoinPrice is also bullish, albeit on a much longer time frame. Setting targets for the next four years, it anticipates prices will hit $833.63 by the end of 2022, around the $956.69 mark in 2023, $1,141.30 by 2024 and $998.13 by 2025.

Of course, with any Binance Coin prediction, algorithms can have imperfections. So it is always worth performing your own analysis and staying up-to-date with current events and information on the cryptocurrency before accepting exposure to it.

FAQs

Binance Coin is issued by the Binance crytocurrency exchange. It is used primarily to pay transaction and trading fees on the exchange. BNB cannot be mined: instead, all of the coins were pre-mined before an initial coin offering, with a price set at $0.10 per BNB.

BNB is designed to serve as the lynchpin of the Binance crytocurrency exchange. It is used to pay for goods and services, settle transaction fees on Binance Smart Chain, and participate in exclusive token sales.

BNB also has a starring role in the Binance Smart Chain, which is vying to become a rival to Ethereum that offers greater levels of scalability along with lower transaction fees

The initial total supply of Binance Coin was defined as 200 million coins, but due to the regular coin burn events, the supply of the coin is slowly decreasing.

BNB is available on Dzengi.com. Always remember to do your own research before investing, and don’t invest more than you can afford to lose.