Can ARPA Chain's approach to blockchain privacy catch on?

Contents

The ARPA Chain aims to solve the problem of balancing decentralisation and privacy, and open up the blockchain to a raft of new opportunities. So what is ARPA Chain and ARPA, its token? What is ARPA Chain used for? How does ARPA Chain work? And what is the ARPA Chain price prediction? Let’s take a look.

ARPA Chain explained

ARPA Chain does not exist on its own blockchain, but works on the Ethereum blockchain. Technically, this means that ARPA is a token, rather than a coin but, in truth, you will hear references to both the ARPA token and the ARPA coin.

The ARPA Chain network is designed to combine two things that benefit both blockchains and traditional networks. One of the attractions of blockchain technology is the decentralised, open model, which allows people to use it without having to worry about hierarchies and authorities. There is, however, a problem with that. Because most blockchains are public, anyone can access them, view transaction histories and work on them. This can be seen as a problem, as it removes an element of privacy which, in turn, has stopped it being adopted as widely as it could be.

The ARPA Chain aims to make data available to use and be shared, without being made publicly available. It does this by using something called multi-party computation (MPC). This is a cryptographic tool that allows a range of users to make calculations without having to share what it is the individual users have done. The idea here could be, for instance, to allow financial institutions to share relevant information without compromising certain pieces of data.

In terms of the ARPA crypto itself, people who help run the network are paid in ARPA as recompense for their time, work and use of computing power. The token can also be used as a deposit for work carried out on the network, with people who do not finish their jobs effectively fined for non-completion.

ARPA holders also have the right to vote on proposals relating to the network. The token itself is subject to 20% of the revenue earned via computations being burned every quarter, thus helping to maintain the token’s price and incentivise the earning of ARPA.

The ARPA token came out in 2019, after an initial coin offering (ICO), which saw it raise $8m. The ARPA network itself was originally founded in 2018 by Felix Xu, who still serves as its CEO, and Yemu Xu.

ARPA chain price history

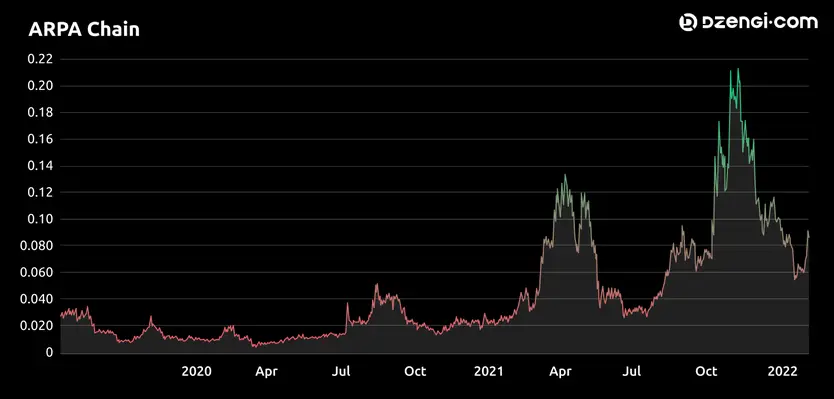

Let’s look at ARPA’s price history. While past performance is no indicator of future results, it can be useful to see how a cryptocurrency has behaved in the past when it comes to look at the ARPA Chain price prediction.

ARPA started being traded on the open market in the summer of 2019. From the middle of July to the middle of August that year, it hovered at around the $0.03 level, but it fell at the end of August and spent most of the autumn trading around the one cent mark. There was some growth to above $0.02 in November that year and in February 2020, but the token mainly spent the time below $0.02. There was a run in August 2020 when it briefly topped $0.05, but then it was back to where it had been.

Things changed in early 2021, which was a notable boom time for cryptocurrency. ARPA responded well to the bullish nature of the market, and this culminated in what was then an all-time high of $0.1446, which it reached on 10 April. The coin then experienced peaks and troughs when it was hit by the market catastrophe of the Great Crypto Day Crash of 19 May. This led ARPA, like many other cryptocurrencies, to spend a large chunk of the summer way down from where it had been earlier in the year.

When the recovery came, things were very good for the coin’s investors. In August, ARPA went from $0.04042 at the start to close at $0.0747, a monthly rise of just under 84% as the coin enjoyed a price boost that saw it hit $0.098 on 3 September. While the market then slumped, things came back for ARPA in October and the coin broke its record price when it reached $0.1656 on 13 October. There was more to come, though, and it reached $0.1921 on 19 October. There were peaks and troughs, but there was still time for it to break through the $0.20 barrier on 2 November, with an all-time high coming the following day at $0.2757.

The coin, like the market, then slowed down as uncertainty surrounding the omicron variant of Covid-19 saw prices fall. At the end of the year, ARPA stood at $0.0974 and January was, ultimately, a bearish month, which saw the coin close at $0.06192. Early February saw a turnaround in the coin’s fortunes, though, and as of 8 February it was trading around $0.087. At this time, there were 1.24 billion ARPA in circulation, out of a total supply of 1.5 billion. This gave ARPA Chain a price cap of about $108.5m, making it the 386th largest crypto by that metric.

ARPA price forecast

Now, let’s take a look at the ARPA Chain price prediction. UpToBrain says that ARPA can really explode in 2022, getting to at least $1.23 this year, and could reach even higher. In 2023, the coin could get to $2.40, while in 2024, the price of ARPA may well be around $5.36, it says. The site’s ARPA Chain price prediction for 2025 sees it continue to rise, hitting $6.35, and the bull run should continue into 2026, when the coin should get to $7.06.

Gov.capital is also optimistic, but it is more cautious than UpToBrain, in terms of its ARPA Chain price prediction. By the end of 2022, the site thinks ARPA should be somewhere between $0.15 and $0.21, with the most likely price being $0.186. By 8 February 2023, it says, the coin should be roughly about $0.225, while a year on from that it should be about $0.445. On 8 February 2025, the coin should be worth around $0.71, Gov.capital thinks, while 12 months after that it should have broken through the dollar barrier to stand at about $1.03. On 8 February 2027, the token should be worth fractions of a cent under $1.40, the site predicts.

CoinArbitrageBot also thinks that the price of ARPA can go up over time. The site’s ARPA Chain price prediction for 2022 comes in at $0.09878, with its forecast for 2023 standing at $0.17583. It thinks that the coin can continue to grow, reaching $0.28449 in 2024 before it reaches around $0.46 in 2025.

Finally, PricePrediction.net thinks that the 10 cent barrier can fall this year, with the coin standing at around $0.13 at some point in 2022. In 2023, the average price of ARPA should be about $0.18, while in 2024 it should be $0.26 and $0.37 in 2025. In 2026, the coin should get to $0.56 and in 2027 it should reach $0.83. The token should break through the dollar barrier in 2028, the site predicts, hitting $1.18, and closing the decade at around $1.70. The site has an ARPA Chain price prediction for 2030, which sees it get to $2.42, and in 2031 the price of the token should be about $3.59, it says.

Final thoughts

While ARPA has been going for nearly three years, it has never quite exploded. Part of this may be due to it operating in a relatively niche part of the crypto sphere, but even so, it has yet to become a major part of many big-time analyst and investor portfolios.

ARPA does have potential and could, in time, be the token that powers some crucial technology but there is always the possibility that someone else will come in and steal the glory. It was NXT that did a lot of things we now associate with Ethereum before Ethereum was even founded, but ETH is today one of the nuggets cryptos and NXT is basically a footnote. We suggest that you act cautiously whenever you want to invest in a cryptocurrency.

FAQs

As of 8 February 2022, there were 1.24 billion ARPA in circulation, out of a total supply of 1.5 billion.

It could be. The idea behind the technology of the ARPA Chain system is interesting, but we will have to see if it will be taken up, how quickly it will be taken up, how many organisations take it up and whether it is the ARPA Chain’s version of the technology that is taken up. You will need to do your own research before committing, and make sure to never invest more money than you can afford to lose.

It might do. The forecasts are largely positive, but then again forecasts are often wrong. At the time of writing, ARPA was moving upwards, but whether market pressures will cause it to drop down again soon remains to be seen. Remember, though, that cryptocurrencies can be highly volatile and prices can go down, as well as up, very quickly.

You will have to answer this question for yourself. Before you do, though, you will need to do your own research, remember prices can go down as well as up, and never invest more money than you can afford to lose.