If you have ever asked 'What is crypto staking?' we can tell you all you need to know

Contents

- What is crypto staking?

- The risks of staking in crypto

- The potential positives of crypto staking

- FAQs

If you have been keeping track of the latest developments in cryptocurrency, then the chances are that you will have heard about crypto staking. It is something that a lot of coins do, and as more and more coins come onto the market, then there are going to be more and more coins that make use of staking in crypto. So, if you have wondered “what is crypto staking?” or “How does crypto staking work?” then we hope this will make it a lot clearer.

First, let us answer one question: What does staking mean in crypto?

What is crypto staking?

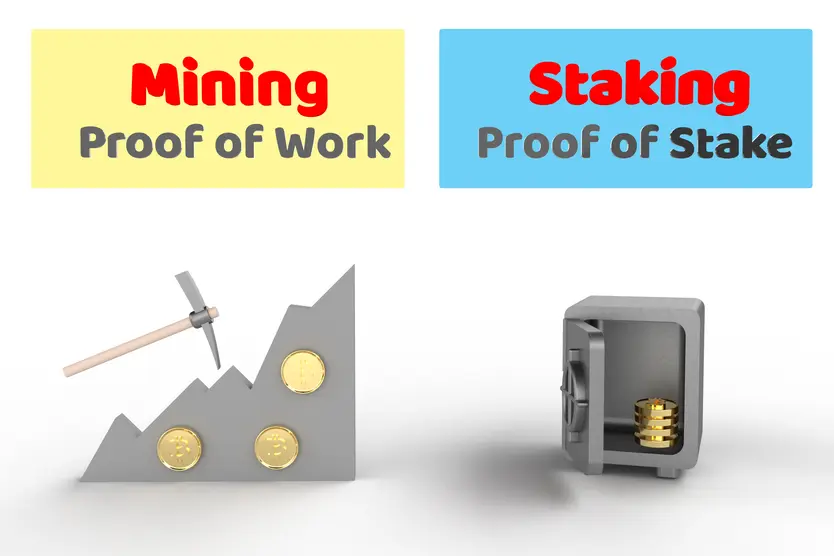

The most simple way of putting it is that staking is an alternative to mining. Traditionally, crypto mining involves using a lot of computing resources to solve increasingly complex mathematical equations, which both add new blocks to the blockchain and unlock – or mint – new crypto coins.

However, there has been something of a push-back against "traditional" mining lately. This is because mining can be very energy-intensive, meaning it uses a lot of electricity, which causes a fair bit of environmental damage. The carbon footprint of some cryptocurrencies is sizeable, which has led to concerns about whether cryptos cause more problems than they solve.

Cryptocurrencies are almost always decentralised. Since they are decentralised, they need something to get them all on the right page. The process they use is called a consensus mechanism.

Cryptos that rely on traditional mining are called proof-of-work. Proof-of-work involves using data relating to crypto mining. It uses data processes to verify transactions and make sure they are not being repeated. Proof-of-work only really works when it comes to simpler blockchains. Bitcoin, for example, can use proof-of-work because the chain itself is fairly straightforward. For other blockchains, however, proof-of-work becomes very inefficient the more complex the processes become. The system gets clogged up, transactions become slower and fees get higher, which annoys customers.

Crypto staking is used by other systems to get around this problem by growing their own blockchains. The idea is that people can add blocks to a blockchain without having to do mining. Instead, they can lock in the crypto coins they already have in a special wallet, thereby ”staking“ them, and, in return, they will be able to add a block to the blockchain at some point. This means that people can, in some cases (at least theoretically), get ahold of new coins without using large amounts of potentially ecologically unsound computing power.

Staking in crypto is also, again in theory, quite a bit faster than mining, meaning there are fewer roadblocks and bottlenecks. And perhaps more importantly, transactions are cheaper, too. This consensus mechanism is called proof-of-stake.

You may wonder why staking in crypto is called staking. This is because when you tie your money into the staking process, you do not automatically get to add the new block to the blockchain and receive rewards. Instead, you have the opportunity to do it. Whoever gets the honour is usually chosen at random, so you are, in effect, gambling, or staking, your crypto resources.

The risks of staking in crypto

There are some risks when it comes to crypto staking.

For example, cryptocurrency is highly volatile, and cryptocoins have also been known to crash pretty heavily. You might get a return of 10% from your staking, but that does not mean anything if the crypto you have staked falls by 25%. You will still have lost your money, because once you have staked your crypto, that money is locked in.

Second, you might end up investing in a network that fails, which will see you losing your assets. Therefore, you need to be careful, do your own research and never invest more than you can afford to lose.

Third, it is also possible that the project itself is a scam. Be careful: remember that if something sounds like it is too good to be true, it probably is.

As with all forms of investing, particularly in cryptocurrency, you have to be very careful. Crypto staking is hardly a guaranteed path to riches, and anyone who tells you otherwise is either a fool, a liar or a con artist (or perhaps all three).

So those are the risks. But what about the rewards?

The potential positives of crypto staking

You might want to stake if you think you can get a return on your investment with the reward payments that are given to people who are staking in crypto. For instance, you might think that staking is a better option than letting your crypto hang around in a wallet until the market moves up enough that you decide to take profits by selling or exchanging your coins.

In staking, as well as getting rewards in the coin you stake, some protocols issue governance tokens, which allow you to have your say in how the network is run. This means you can feel more involved in the world of crypto.

You can also team up with other stakers on some protocols to create a staking pool, which allows people to pool their staked crypto and share in the rewards if and when they are chosen to validate blocks on the blockchain.

There is another process called cold-staking, which involves staked coins being kept in an offline wallet. This only really works when there is a seriously significant amount of virtual cash involved, but it does have the advantage of being much more secure than keeping it in an online wallet.

There is no "best crypto for staking". You will need to make sure you are using a blockchain that supports proof-of-stake (for instance, Bitcoin is proof-of-work and does not allow staking). As always, it is essential that do your own research so that you are clear about the potential risks and rewards.

FAQs

Crypto staking is not without its risks. The value of the coin you are staking could go down, the protocol might close or you might fall victim to a scam. You will need to do your own research before you decide to stake your crypto.

If you want to make money staking crypto, you will need to do some research. You will also need to be patient, because your money will be locked in until you get selected to add a new block to the blockchain.

There is also no guarantee that you will make money when this happens, though, because the value of the coin could have fallen significantly. You must never invest more money than you can afford to lose.

It can be, if you are lucky. Like all forms of gambling, the activity from which crypto staking gets its name, there is the random factor, as well as the possibility, of things going wrong.

There is nothing wrong with getting involved in crypto staking, but you need to make sure you are informed about what can happen.

It is, potentially, providing you stake your money in a cryptocurrency whose value does not go down by more than the rewards you will get once you are chosen to add to the blockchain. The flipside is that the value of the crypto could go down, leaving you out of pocket.

Remember that cryptocurrencies can be very volatile and prices can go down as well as up. Therefore, never invest or stake more money than you can afford to lose.