Learn the difference between a cable, fiber and guppy: the opportunity and the risk for forex traders

What is a currency pair?

The foreign exchange (forex) market is one of the biggest and most active markets. If you decide to become a forex trader, you should start by learning how the market operates and what a currency pair is.

In simple terms, trading on the forex market means making profits by the purchase or short-selling of one or more currency pairs. Using different technical analysis indicators, fundamental analysis or both, you evaluate the future movement of one currency in relation to another.

Let’s look at the basics . All currencies are defined according to the international standard code or ISO currency code, and labelled with three-letter tags. A currency pair comprises two different currencies, where the first is called the base currency and the second is the quote currency.

The value following the currency pair denotes how many units of the quoted (second) currency equal one unit of the base currency. In other words, it shows how many units of the quoted currency you will need to buy one unit of the base currency. For instance, the pair EUR/USD is quoted at 1.11 and so you will need $1.11 to buy €1.

Executing forex trade orders means that you buy the base currency and sell the quoted currency at the same time. A sell order would be performed by selling the base currency and buying the quoted currency.

Categorising currency pairs

There are different categories of currency pairs, such as:

- Major currency pairs – these contain the US dollar and are commonly thought to be among the most liquid pairs

- Cross currency pairs – where the US dollar is neither a base or quoted currency

- Minors – cross currency pairs that contain some of the other major currencies such as the EUR, JPY or GBP

- Exotics pairs – these contain one major currency and one from an emerging market

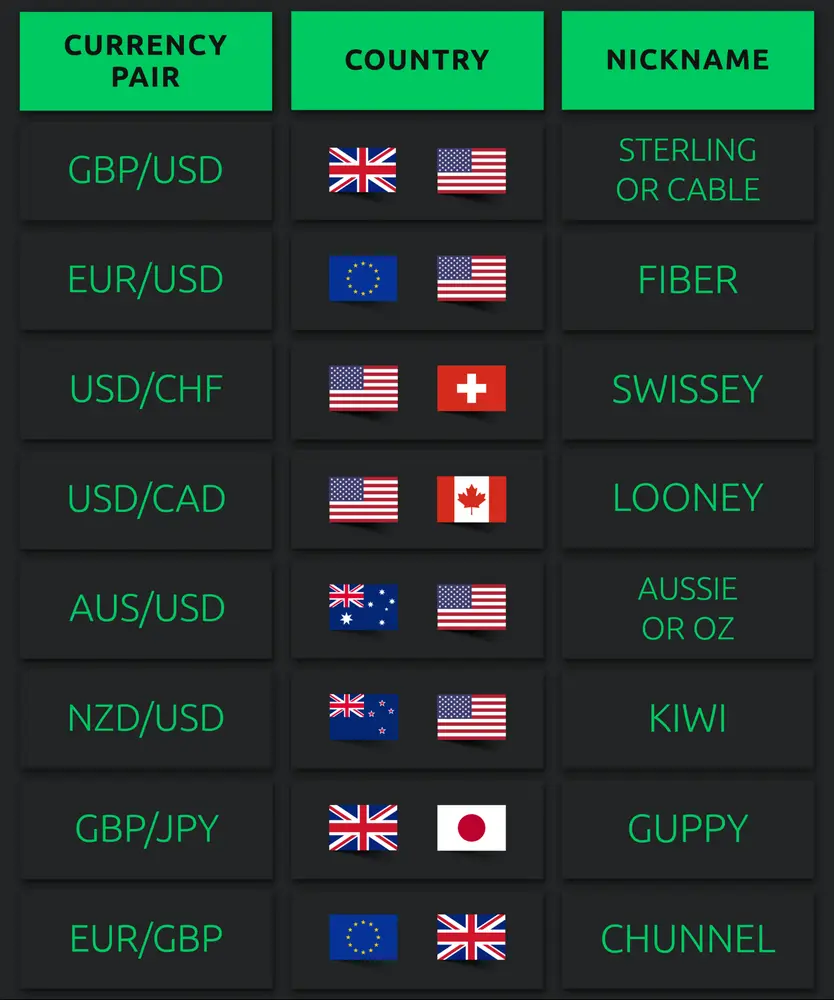

Traders give some of the most popular currency pairs specific nicknames. You can see some in the following table:

So, if you hear traders saying that they bought the cable, it means that they have traded the GBP/USD currency pair.

Most volatile forex pairs

Currency pairs differ in terms of volatility levels and you can decide to trade highly volatile pairs, or pairs with lower volatility. The volatility of a currency pair shows price movements during a specific period. Smaller price movements will indicate lower volatility whereas higher or frequent movements mean higher volatility.

The price movement of the currency pair is commonly considered in terms of pips, so a currency pair moving 200 pips on average during a given period will be more volatile than a pair moving 20 pips in the same period. The volatility level is affected by major economic data releases and political events, as well as liquidity or simply supply and demand of the pair.

Remember that the volatility of a currency pair can change over time as the relevant factors change. But overall, the pairs below are considered some of the most and least volatile.

Most volatile currency pairs

- AUD/USD

- GBP/AUD

- AUD/JPY

- CAD/JPY

- USD/TRY

Least volatile currency pairs

- EUR/USD

- EUR/GBP

- USD/CHF

- EUR/CHF

Exotic currency pairs are considered more volatile because of limited liquidity, along with unstable economic conditions in emerging economies. So exotic currency pairs have, on average, much higher price fluctuations compared with cross pairs or majors.

How to trade currency pairs

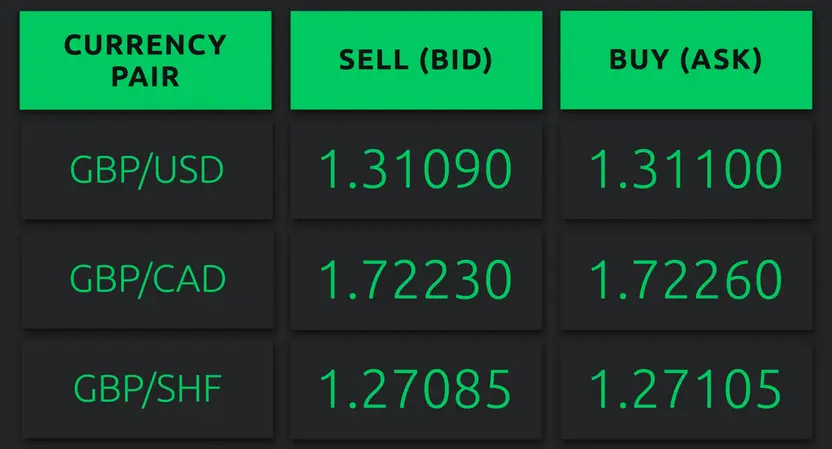

You may notice on your trading platform that two prices are quoted for each currency pair, the bid (buy) price and the ask (sell) price. The difference between the two is called a spread.

The bid and ask prices are shown from a broker's standpoint. The bid price is how much a broker will pay when buying the currency pair and the ask price is that at which the broker is willing to sell. The ask price will always be higher, because brokers sell you the pair for more than their purchase (bid) price.

The trader pays the ask price when buying a currency pair and sells the pair for the bid price. Some trading platforms label prices as sell and buy price, so always remember that the trader buys at the higher quoted price and sells at the lower one. This table lists the "bid and ask" or the "sell and buy" prices for some pairs in which GBP is the base currency.

When traders decide to sell the GBP/USD pair, they receive $1.31090 for one GBP or if they decide to buy, they will pay $1.3110 (the higher price). The difference between the two is the spread and as you can see, there could be a different spread depending on the currency pair. Traders prefer smaller spreads because the price movement should cover the spread before a trade becomes profitable.

Opening positions in the forex market means that you ultimately consider the relationship between the currencies in terms of whether one strengthens or weakens compared with the other. There are two ways for traders to make a profit:

- The base currency strengthens or weakens

- The quoted currency strengthens or weakens

Let’s take the GBP/USD pair as an example, and assume all other factors affecting the rate remain the same. When the GBP, as a base currency, strengthens, then the GBP/USD value will increase. If the GBP weakens, the value of the pair will decrease. Conversely, when the US dollar strengthens in relation to the GBP, the GBP/USD price will decline. If the US dollar weakens, the GBP/USD value will rise.

Most traded currency pairs

Currency pairs can be affected by many factors and each has characteristics that attract or repel traders. They can choose to trade a currency pair based on volatility, liquidity, volume or some other factor. The list of most traded forex pairs can include currencies that significantly differ in terms of their characteristics. Some of the most traded pairs are:

- EUR/USD (euro/US dollar)

- GBP/USD (British pound/US dollar)

- EUR/GBP (euro/British pound)

- USD/CHF (US dollar/Swiss franc)

- USD/JPY (US dollar/Japanese yen)

- EUR/JPY (Euro/Japanese yen)

- AUD/USD (Australian dollar/US dollar)

- EUR/AUD (Euro/Australian dollar)

- USD/CAD (US dollar/Canadian dollar)

- GBP/JPY (British pound/Japanese yen)

Best forex pairs to trade

There is no precise answer as to which forex pairs are best for trading, because it depends on what you look for as a trader.

If you want the opportunity to make higher gains (more pips) through higher risk exposure, consider some of the most volatile pairs. If you are interested in more stability, you could trade some of the less volatile pairs, or currency pairs from the most stable economies. Alternatively, you can trade major currency pairs or you can trade exotic pairs or crosses.

The spread between the bid and ask price can also be a factor when choosing which currency pair to trade. Or you could know a lot about a certain economy and decide to trade pairs that include its currency. There is a long list of currency pairs, and the decision depends on personal preferences.

However, when selecting a currency pair, pay attention to volume and liquidity, which ensures an adequate level of demand and supply. Don't forget that with volatile currency pairs you can make higher profits, as there could be much higher price fluctuations.

Trading major currency pairs is considered to carry lower risks compared with other types of pairs, and it is recommended that new traders select one pair with high liquidity and an acceptable level of volatility until they become better acquainted with forex trading.

FAQs

EUR/USD: The euro and US dollar dominate daily trading. Figures from 2019 show the dollar’s marketshare at 88%, with the euro on 32%. The currencies of two of the biggest, most mature economies in the world. Together, traders call the pair the “Fiber”.

There is no bigger financial market on the planet. Currency trading reached a record $6.6tn a day in 2019. There is money to be made investing in forex. But, like any other investment, money can be lost.

Dzengi.com offers regulated forex trading through tokenised currency pairs. Learn how to trade on the platform. Be mindful that prices go up and prices go down. Invest only that much that you can afford to lose. Do you own research.