Non-fungible tokens (NFTs) have exploded on the scene in recent months, with several top football clubs, music bands and fashion houses getting in on the act. But how do these tokens work?

After years of being regarded as a rather niche sector of the cryptocurrency industry, non-fungible tokens (NFTs) have exploded in popularity in 2021.

In recent months, we’ve seen some of the world’s biggest brands launch their own NFT tokens. The BBC has released an array of NFTs as part of a Doctor Who game – and several major sporting organisations have also launched tokenised versions of top athletes. Even fashion houses like Burberry and film directors like Wong Kar Wai are getting in on the act.

But what are NFT tokens? How do NFT tokens work? and why are some of these digital assets managing to sell for hundreds of thousands of dollars? If you want NFT tokens explained simply, you’ve come to the right place.

What are non-fungible tokens (NFTs)?

Non-fungible tokens (NFTs) are different to major cryptocurrencies such as Bitcoin – and the clue is in the name.

If an item is fungible, this means that it can easily be replaced by something identical. A $20 note is a good example of this – if you lend one to a friend, you won’t notice if you’re given a different $20 note back.

Non-fungible assets are the exact opposite. Imagine a No. 1 Trainer Pokemon card – one of the rarest in the game’s existence, with just seven believed to be in circulation. It may look like a normal card from a distance, but it has distinctive qualities that makes it different from all the others. If you lent THAT to a friend and got a different one back, you’d be understandably upset.

Non-fungible tokens bring this rarity and scarcity to the blockchain. They allow digitised versions of collectibles to be created.

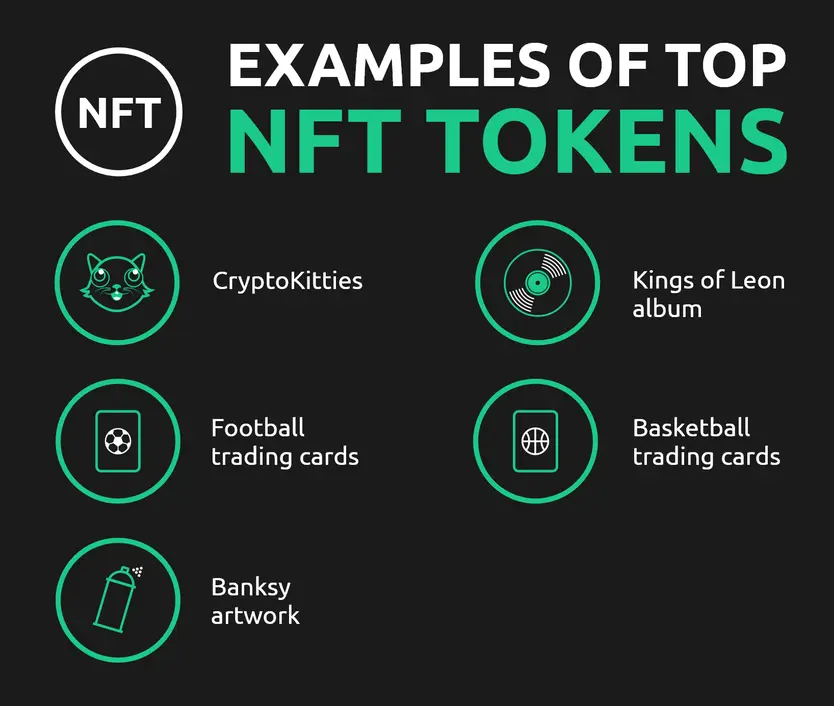

One of the earliest examples of NFTs came in the form of CryptoKitties, which gave enthusiasts the chance to breed digital cats. Someone once paid 600 ETH for an especially rare kitty, which at today’s rates would be worth an eye-watering $1m.

Now, enthusiasts believe that non-fungible tokens could shake up the world of art and gaming – offering tangible improvements to both sectors. In recent months, we’ve seen a proliferation of digital artwork, with some masterpieces selling at prestigious auction houses for hundreds of thousands of dollars. (Beeple, one well-known artist, created a piece called Ancient Technology that showed a retro Game Boy under construction, illustrating how the devices we use every day have evolved in a few short years.)

For the gaming sector, NFTs could transform the experience for players. They could pave the way for extremely rare in-game items that can be transported between titles. These assets could also be bought and sold on secondary marketplaces, potentially in exchange for cash. All of this would create a sense of ownership that is often lacking from the in-game extras that are usually offered through games at the moment.

How do NFT tokens work?

NFT tokens are often based on the Ethereum blockchain – but levels of congestion seen on this network have meant digital assets have started to be created on rival platforms.

To create the kind of scarcity that gives NFT tokens their value, developers need to ensure the supply of tokens is strictly limited. It’s also common for tokens to be split into varying degrees of rarity, meaning that only a small number of the most desirable tokens will ever exist. NFTs for some crypto games are sold in packs, meaning that every player has a chance of getting their hands on one of the most coveted NFTs.

Another thing that sets NFTs apart from major cryptocurrencies such as Bitcoin and Ether is the fact they cannot be divided into smaller chunks. Whereas it’s easy to send 0.05 BTC to a friend, it’s impossible to send 5% of an NFT in a similar fashion.

Last, but not least, one of the most common advantages of NFTs lies in how blockchain platforms can help verify the authenticity of an asset and provide a comprehensive history of ownership.

Some believe a proliferation of NFTs could breathe fresh life into the embattled music sector, which has been hit hard by the coronavirus pandemic. Kings of Leon were recently pioneers when they launched their eighth studio album in tokenised form, enabling fans to place a bid. The rarest token available offered some insane perks, including front-row seats to the band’s concerts for life, piles of merchandise and a chauffeur.

NFT token examples are everywhere in the cryptoworld these days, but just because they are ubiquitous, that does not mean that they are necessarily a good thing.

Are there any downsides to NFTs?

Over the past 10 years or so, the crypto sector has regularly been gripped by crazes. A notable example comes in the form of initial coin offerings (ICOs), which exploded in popularity in 2017. Here’s the problem: many investors lost substantial amounts of money owing to scams and projects that never came to fruition.

Some critics, such as Litecoin founder Charlie Lee, believe the sudden spike in NFT trading activity is extremely problematic.

He predicted the supply of NFTs will eventually overtake demand, causing prices to crash. This will create big problems for those who spent six-figure sums to get their hands on rare tokens, all with a hope of selling it for a profit in the future.

Warning that NFTs create artificial scarcity, Lee wrote:

“Unlike NFTs, real-world art is not zero cost. It takes effort and time to create a piece. This is effectively proof-of-work. A famous artist like Picasso can only create thousands of pieces of art in his lifetime. This limitation creates scarcity, which helps keep the value high. NFTs, on the other hand, create artificial scarcity. Because of the near-zero cost to create another NFT, the market will eventually be flooded with NFTs from artists trying to cash in on this craze.”

NFT market explosion

The size of the market in non-fungible tokens has boomed in 2021. The first six months of the year saw a total of $2.5bn spent on the tokens, up from a comparatively small $13.7m over the course of the first half of 2020. The market managed to grow from that already impressive figure – as of 15 September, 30-day sales of NFTs stood at just under $2.571bn. Interestingly, this was down slightly from 13 September, when the 30-day score stood at just under $2.583bn – a record.

That said, the market for NFTs has actually gone down on a daily basis from 28 August, when the total amount of daily sales came in at $267,664,826.35. Sales figures for 15 September of $19,083,542.41 represent a staggering drop of just under 93%, putting the current market roughly where it was in the middle of August.

Whether the events of 28 August were a fluke and the general equilibrium of the NFT market is where it should be right now, or if this is just a temporary dip before another bullish period or whether we are currently at the start of a crash, all remain to be seen.

It might be worth pointing out that Chinese state media has jumped on the anti-NFT bandwagon, with Beijing-controlled paper Security Times writing: “It is common sense that there is a huge bubble in NFT transactions... many buyers only focus on NFT as a format instead of the artwork or asset itself.” It will be interesting to see if China cracks down on the trade in NFTs in the near future.

Non-fungible token news: scandal and cinema

Meanwhile, the world of NFTs was rocked in September when peer-to-peer digital marketplace OpenSea admitted it had a problem with insider trading. One of the site’s employees, who has not been publicly identified by OpenSea, was found to have got a secret wallet with which he would purchase NFTs shortly before they were listed by the platform. Once they were up, he would sell them at a profit.

In a statement, Devin Finzer, co-founder and CEO of OpenSea, said: “When we launched OpenSea, there was only one collection on our platform: CryptoKitties. Today, there are 20 million NFTs to discover on OpenSea. We owe this growth to the vibrant community of creators and collectors who use our platform every day, and we have a strong obligation to this community to move it forward responsibly and diligently.”

Finzer continued: “The behavior of one of our employees violated that obligation and, yesterday, we requested and accepted his resignation. We do not take this behaviour lightly. Upon learning of this conduct, we immediately commissioned a third party to conduct a thorough review of the incident and make recommendations on how we can strengthen our existing controls. That review is ongoing, but we are committed to quickly implementing its recommendations.”

Meanwhile, electronic music NFT platform RCRDSHP announced it had received a “multi-million” amount of funding in a seed round. Other NFT platforms to have raised significant cash through seed rounds recently include Makers Place, which generated $30m in August, and OneOf, which raised $63m in May.

And now, what claims to be “the world’s first” NFT film is due to be released on 24 September 2021. Zero Contact, a science-fiction thriller starring Academy Award-winning actor Anthony Hopkins, will also be releases by NFT film distributors Vuele, who will have its first 11 digital copies made available via an OpenSea auction on the same date of the film’s release.

A further 2,500 NFTs will be made available in October. While the official movie will be released in cinemas, token holders will be able to access special features such as out-takes and interviews with cast members.

There are literally millions. For instance, the Axie Infinity platform has more than six million on its site alone. There are new ones being made and added to platforms every day.

You can buy NFTs on a variety of NFT platforms. We do, however, urge you to do your own research on the matter. NFTs are incredibly volatile, and prices can go down as well as up. You must remember to never invest more money than you can afford to lose.

You can buy NFTs on a range of NFT platforms. Although we do not currently sell them on dzengi.com, we will let you know if and when we do.