If you worry that the coronavirus will cause a global recession, this guide is for you

When should you consider recession investments?

Central banks are estimating that some countries could enter a recession due to the decline in economic activities and other consequences arising from the coronavirus.

The coronavirus outbreak has caused a decrease in the manufacturing sector as a large number of factories and production capacities have been forced to close their operations. This, plus obstacles faced by transportation companies and other factors have negative effects on international trade and the worldwide supply chain.

Estimations show that the air transportation industry will suffer losses of tens of billions because the outbreak has dramatically reduced the number of people flying. The coronavirus in Italy has already harmed the tourism and leisure industry as a large number of hotel bookings for March and April, more than 50 per cent in some cities, have already been cancelled.

Investor behaviour is also an indication of fear that the global economy will enter a recession. Investors move their capital towards low-risk investments which decreases the yield offered by government bonds and also has a positive impact on gold prices. So, if the situation does get worse, what are the best investments during a recession?

What is economic recession?

Recession is a state of the economy when industrial activity, trade, spending and the GDP (Gross Domestic Product) level is temporarily decreased. The GDP represents the total quantity of produced goods and services in one economy. From an economist's perspective, a recession is defined as when the economy has two consecutive quarters of decreased economic growth.

In a recession, companies are faced with lower revenues and they resort to cost-cutting activities such as lay-offs. Because all economic activities and participants are interrelated, the increased unemployment often causes a decrease in consumer spending which in turn impedes economic growth and pushes the economy into a deeper recession. In addition, in periods of economic downturn, the value of stocks and other assets such as residential properties decline as demand is decreased.

Sometimes the term recession is used interchangeably with economic depression but the second is a much more severe form of economic downturn with substantial negative effects on the economic activities and economic growth. It is estimated that recessions can last up to 18 months while depressions last longer.

A recession also has an impact on investment decisions because of investors moving towards less risky assets. In periods of declining stock prices, investors want to know whether they should sell off their holdings, wait for economic recovery or invest in other assets.

Should you make investments during a recession?

The answer is "yes" and it’s better to know how to act and make an adequate investment decision in a period of economic downturn. You can't just stop being an investor until the economy starts to grow again. Some reputable experts even believe that periods of recession can provide a variety of opportunities for long-term investors due to the potential of a substantial decline in prices, which makes the assets cheap.

How to invest during a recession

Although it may sound tempting to buy cheap assets during a recession, investors should be careful. As you invest in the long-run movement of the asset value, it's important to examine the long-term outlook of the underlying asset first. Also, define a recession-proof investment strategy to create a well-diversified portfolio composed of assets which will offset losses during a recession or increase profits during expansion.

What to invest in during a recession

Let’s go through the assets which could be adequate investments during a recession.

Recession-proof stocks

When the economy is faced with a recession, cyclical stocks would not be the best choice. Counter-cyclical companies could be a good investment opportunity because their price can increase even when there is economic decline. Don't forget that during an economic expansion, the price of country-cyclical stocks decreases, which means that you should have an adequate exit strategy.

Examples of industries which perform well during recessions include the healthcare, utilities, funeral or consumer goods industries because, whatever happens, people will need medical attention, food and electricity. Consequently, the companies in these industries can be thought of as recession-proof stocks. These industries are also referred to as recession-resistance industries or defensive industries.

You could also consider stocks from reputable companies, such as 0'>Coca-Cola, 0'>Google or similar companies, as reliable recession investments. The idea here is that it is highly unlikely that these companies will go bankrupt due to the recession as they are well-established businesses. Hence, when their price hits the low during the peak of the recession, what comes next is for the price to move upwards. Accordingly, you can buy stocks from healthy companies for a much lower price than you would during an economic boom. As an example, we could look at the stock of The Coca-Cola Company (KO). By the end of 2008, the stock hit a low of approximately £17 ($22) while at the end of 2019 it had a share price of around £42 ($55). An investor would have more than doubled the money in 10 years.

It should be noted that, ideally, investors avoid companies with high levels of debt, questionable liquidity and solvency. At the same time, they prefer to hold companies with low debt and strong cash flow. You could look to invest in – with their long history of paying dividends – during the recession as they can buy these stocks for a much lower price.

Real estate investment

The 2008 crisis was marked by a severe crash for the real estate market because the value of residential property, and property in general, dropped drastically. Homes which were valued at hundreds of thousands of pounds or dollars before the crisis were sold at a fraction of their worth during it.

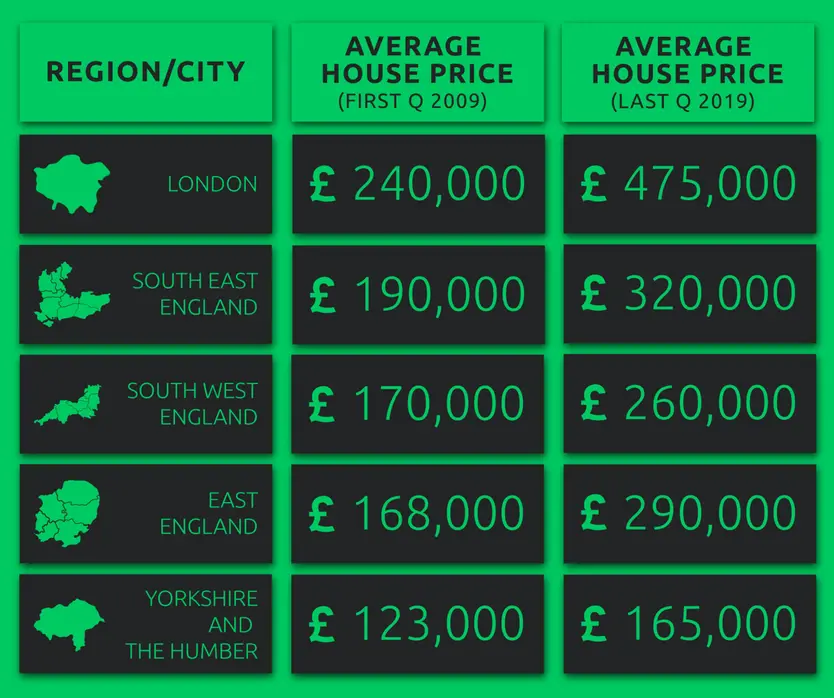

However, in the past decade in London house prices have nearly doubled. The average house price in London, in the first quarter of 2009 was approximately £240,000, whereas the average house price during the last quarter of 2019 was around £475,000. Look at the table for the average house price in some other areas of the UK.

Gold as an investment

The precious yellow metal has proven itself to be resistant to crises because 0'>gold usually increases in price during economic downturns. As the value of national currencies declines due to inflation and overall economic uncertainty, people tend to purchase gold to store their value. The increased demand for gold and the weakening currency or deflation puts positive pressure on the gold price.

For instance, at the beginning of 2007, before the start of the last global financial crisis, gold was priced at £314 per ounce, while the price increased to more than £610 before the official end of the recession in 2009.

Bonds as a viable investment

Government bonds and highly rated corporate bonds are another type of instrument which should be considered as potentially safe investments during a recession. Namely, government bonds are thought of as risk-free assets which can provide a fixed income stream. However, the lower risk comes at a certain cost and that is the low yield due to the increased demand for bonds. Government bonds can be a nice addition to your portfolio when the economy is facing a recession.

Alternative investment assets

Aside from the financial instruments available for investing, there are other types of assets which can be considered recession-proof investments, such as alternative investment assets. The idea is that these will not be subject to drastic price decreases in economic downturns while their price will steadily increase year after year. Investors can expect the value of alternative assets to increase because of the individual characteristics of each asset. Assets such as art, limited edition products, rare items and antiques can fall within this category. Imagine if you could purchase a painting from Picasso now. How much do you think this painting will be worth in 10 years? What about in 20 years?

Most likely you will have heard of a car with an initial sale price of only a few thousand pounds that has been sold for hundreds of thousands, even millions of pounds, after a couple of decades. Do you know what happens with the price of cars which are part of a limited series when someone smashes one of the cars? Well, the value of the remaining cars goes up since the available number is decreased (lower supply).

As you can see, there are numerous opportunities which can be suitable investments during a recession. Selecting the best one may be difficult so you can choose several types and set up a recession-proof portfolio. This will enable you to maintain your position in times of recession and make profits after the tough time is over.

FURTHER READING: Italy is on total lockdown

FURTHER READING: Coronavirus prompts OPEC to cut forecast for 2020 oil demand growth